Best Personal Finance Software for Budgeting

{ "article": [ { "title": "Best Personal Finance Software for Budgeting", "meta_description": "Find a curated list of the best personal finance software tools to assist with budgeting and financial tracking.", "content": "Find a curated list of the best personal finance software tools to assist with budgeting and financial tracking.\n\n

Hey there, money maestros! Are you tired of feeling like your finances are a tangled mess? Do you wish you had a clearer picture of where your money goes each month? Well, you're in luck! In today's digital age, managing your personal finances has never been easier, thanks to a plethora of fantastic personal finance software tools. These aren't just fancy calculators; they're powerful allies designed to help you budget, track your spending, set financial goals, and ultimately, achieve financial peace of mind. Whether you're a budgeting beginner or a seasoned saver, there's a tool out there that's perfect for you. Let's dive deep into the best options available, comparing their features, use cases, pricing, and more.

\n\nUnderstanding Personal Finance Software What to Look For

\n\nBefore we jump into specific recommendations, let's talk about what makes a great personal finance software. It's not a one-size-fits-all situation, so understanding your needs is key. Here are some crucial features to consider:

\n\n- \n

- Budgeting Tools: This is often the core function. Look for software that allows you to create custom budgets, categorize expenses, and track your spending against your budget in real-time. \n

- Transaction Tracking: Can it automatically import transactions from your bank accounts, credit cards, and investment accounts? Manual entry can be tedious. \n

- Net Worth Tracking: Does it provide a holistic view of your assets (bank accounts, investments, property) minus your liabilities (debts) to show your overall financial health? \n

- Goal Setting: Can you set specific financial goals, like saving for a down payment, retirement, or a vacation, and track your progress towards them? \n

- Reporting and Analytics: Good software offers insightful reports and visualizations to help you understand your spending habits, income trends, and financial progress. \n

- Bill Management: Does it help you track upcoming bills and avoid late fees? \n

- Investment Tracking: If you have investments, can it integrate with your brokerage accounts to track performance? \n

- Security: This is paramount. Look for robust encryption, multi-factor authentication, and a strong privacy policy. \n

- Ease of Use and User Interface: Is the software intuitive and easy to navigate? A clunky interface can deter you from using it consistently. \n

- Mobile App: Is there a well-designed mobile app for on-the-go financial management? \n

- Customer Support: What kind of support is available if you run into issues? \n

- Pricing Model: Is it free, subscription-based, or a one-time purchase? \n

Top Personal Finance Software Recommendations for Budgeting and Tracking

\n\nAlright, let's get to the good stuff! Here are some of the top contenders in the personal finance software arena, each with its unique strengths.

\n\nMint The Free All-Rounder for Budgeting and Tracking

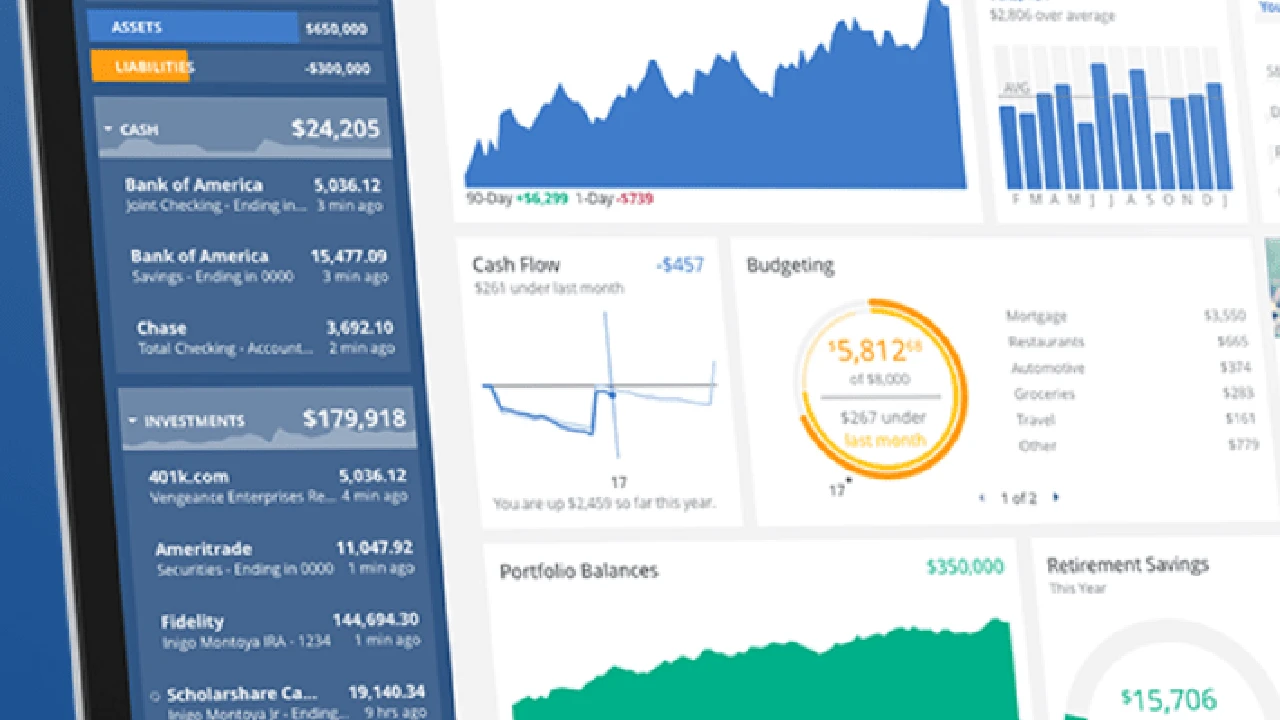

\n\nOverview: Mint, by Intuit (the makers of TurboTax and QuickBooks), is arguably one of the most popular free personal finance tools out there. It's fantastic for getting a comprehensive overview of your finances, from budgeting and spending to credit score monitoring and investment tracking. It aggregates all your financial accounts in one place, making it super convenient.

\n\nUse Cases: Ideal for individuals and families who want a free, easy-to-use platform to track spending, create budgets, and monitor their overall financial health. Great for beginners who are just starting their budgeting journey.

\n\nKey Features:

\n- \n

- Automatic Transaction Categorization: Mint automatically categorizes your transactions, though you can always adjust them. \n

- Customizable Budgets: Create and track budgets for various spending categories. \n

- Bill Reminders: Get alerts for upcoming bills to avoid late payments. \n

- Credit Score Monitoring: Free access to your credit score and factors affecting it. \n

- Net Worth Tracking: See your assets and liabilities in one dashboard. \n

- Investment Tracking: Connect your investment accounts to monitor performance. \n

- Financial Goals: Set and track progress towards various financial goals. \n

- Mobile App: Excellent mobile app for iOS and Android. \n

Pros: Free, comprehensive features, user-friendly interface, strong mobile app, widely supported by financial institutions.

\n\nCons: Ad-supported (can be a bit intrusive for some), categorization isn't always perfect, customer support can be limited.

\n\nPricing: Free.

\n\nYou Need A Budget YNAB The Budgeting Powerhouse

\n\nOverview: YNAB (You Need A Budget) is not just a budgeting app; it's a budgeting philosophy. It's based on the 'zero-based budgeting' method, where every dollar is assigned a job. This approach helps you be incredibly intentional with your money, preventing overspending and helping you save more effectively. YNAB is known for its active community and excellent educational resources.

\n\nUse Cases: Perfect for those who are serious about getting their finances in order, want to be very hands-on with their budgeting, and are committed to the zero-based budgeting methodology. Great for debt repayment and aggressive saving goals.

\n\nKey Features:

\n- \n

- Zero-Based Budgeting: Assign every dollar a job, ensuring no money is left unaccounted for. \n

- Rule-Based Budgeting: Follows four rules: Give Every Dollar a Job, Embrace Your True Expenses, Roll with the Punches, and Age Your Money. \n

- Goal Tracking: Robust goal-setting features for various financial objectives. \n

- Detailed Reporting: In-depth reports on spending, net worth, and income. \n

- Direct Import: Connects to bank accounts for automatic transaction import. \n

- Mobile App: Highly functional mobile app for budgeting on the go. \n

- Educational Resources: Extensive library of articles, videos, and workshops to help you master budgeting. \n

Pros: Highly effective for changing financial habits, excellent customer support, strong community, no ads, very secure.

\n\nCons: Subscription fee, steep learning curve for some, requires consistent engagement to be effective.

\n\nPricing: Approximately $14.99 per month or $99 per year (prices can vary slightly).

\n\nQuicken The Desktop Classic for Comprehensive Financial Management

\n\nOverview: Quicken has been around for decades and is a veteran in the personal finance software space. It's a robust, feature-rich tool that goes beyond basic budgeting, offering comprehensive financial management for investments, property, and even small businesses. While it started as desktop software, it now offers cloud syncing and mobile apps.

\n\nUse Cases: Best for individuals or families with complex financial situations, including investments, rental properties, or small business income/expenses. Ideal for those who prefer a desktop-first experience with powerful reporting capabilities.

\n\nKey Features:

- Comprehensive Financial Tracking: Manages banking, credit cards, investments, loans, and even property.

- Advanced Budgeting: Create detailed budgets and track spending.

- Investment Tracking and Analysis: Robust tools for monitoring portfolio performance, analyzing investments, and tracking capital gains.

- Tax Planning: Helps categorize transactions for easier tax preparation.

- Bill Pay: Manage and pay bills directly from the software.

- Net Worth Tracking: Provides a detailed view of your net worth across all assets and liabilities.

- Customizable Reports: Generate a wide range of reports to analyze your financial data.

- Desktop Software with Cloud Sync: Offers the power of desktop software with the convenience of cloud access and mobile apps.

Pros: Extremely comprehensive, powerful investment tracking, long-standing reputation, good for complex financial situations.

Cons: Subscription model, can be overwhelming for beginners, user interface can feel a bit dated compared to newer apps, primarily desktop-based.

Pricing: Varies by version (Starter, Deluxe, Premier, Home & Business). Deluxe is around $51.99/year, Premier around $77.99/year, and Home & Business around $103.99/year (prices are for the first year and may increase upon renewal).

Personal Capital Empowering Investment Tracking and Net Worth

Overview: Personal Capital (now Empower Personal Dashboard) is a fantastic tool, especially if you're focused on investment tracking and overall net worth. While it offers budgeting features, its strength lies in its ability to aggregate all your investment accounts, track performance, analyze fees, and provide a holistic view of your financial future. They also offer financial advisory services, but you can use the free tools without engaging with their advisors.

Use Cases: Excellent for investors who want a clear, real-time view of their portfolio performance, net worth, and retirement planning. Also good for those who want basic budgeting but prioritize investment insights.

Key Features:

- Net Worth Tracker: A beautiful and intuitive dashboard showing your real-time net worth.

- Investment Checkup: Analyzes your portfolio for diversification, risk, and hidden fees.

- Retirement Planner: Helps you project your retirement readiness based on your current savings and investments.

- Cash Flow Analyzer: Tracks your income and expenses, though less detailed than dedicated budgeting apps.

- Fee Analyzer: Identifies hidden fees in your investment accounts.

- Mobile App: Strong mobile app for on-the-go monitoring.

- Financial Advisory Services: Optional, paid financial advisory services for those with higher asset levels.

Pros: Free, excellent for investment tracking and net worth analysis, clean and modern interface, powerful retirement planning tools.

Cons: Budgeting features are less robust than dedicated budgeting apps, frequent prompts for advisory services (though you can decline), no bill pay.

Pricing: Free for the dashboard and tools. Financial advisory services are fee-based (typically a percentage of assets under management).

Simplifi by Quicken The Modern Budgeting Solution

Overview: Simplifi is Quicken's answer to modern, cloud-based budgeting. It's designed to be simpler and more intuitive than traditional Quicken, focusing on budgeting, spending tracking, and cash flow. It's a great option if you like the idea of Quicken but want something less complex and more streamlined for everyday money management.

Use Cases: Ideal for individuals and families who want a modern, cloud-based budgeting and spending tracker without the complexity of full-blown investment management. Good for those who want to understand their cash flow and spending habits easily.

Key Features:

- Real-Time Spending Tracking: Automatically categorizes transactions and shows you where your money is going.

- Customizable Spending Plan: Create a personalized spending plan based on your income and goals.

- Subscription Tracking: Identifies and tracks your recurring subscriptions.

- Cash Flow Projections: Helps you see your projected cash flow for the month.

- Net Worth Tracking: Provides a clear overview of your assets and liabilities.

- Goal Setting: Set and track progress towards various financial goals.

- Mobile App: User-friendly mobile app for managing finances on the go.

Pros: Modern interface, easy to use, strong focus on budgeting and cash flow, good mobile app, no ads.

Cons: Subscription fee, less comprehensive for investment tracking compared to full Quicken or Personal Capital, newer product so features are still evolving.

Pricing: Approximately $3.99 per month or $47.88 per year (prices can vary slightly).

Comparing the Best Personal Finance Software for Your Needs

Let's put them side-by-side to help you decide:

| Software | Best For | Key Strengths | Key Weaknesses | Pricing Model |

|---|---|---|---|---|

| Mint | Beginners, free budgeting, overall financial overview | Free, comprehensive, easy to use, good mobile app | Ad-supported, less precise categorization, limited customer support | Free |

| YNAB | Serious budgeters, debt repayment, aggressive saving, zero-based budgeting | Highly effective for habit change, excellent support, no ads, very secure | Subscription fee, learning curve, requires consistent engagement | Subscription ($14.99/month or $99/year approx.) |

| Quicken | Complex finances, investors, small business owners, desktop preference | Extremely comprehensive, powerful investment tools, tax planning, bill pay | Subscription fee, can be overwhelming, dated UI, primarily desktop | Subscription (Varies by version, e.g., Deluxe $51.99/year approx.) |

| Personal Capital | Investors, net worth tracking, retirement planning, fee analysis | Free for tools, excellent investment insights, beautiful net worth dashboard | Basic budgeting, frequent advisory service prompts, no bill pay | Free (tools), Fee-based (advisory services) |

| Simplifi by Quicken | Modern budgeters, cash flow focus, cloud-based preference | Clean interface, easy to use, good cash flow projections, subscription tracking | Subscription fee, less comprehensive for investments, newer product | Subscription ($3.99/month or $47.88/year approx.) |

Choosing the Right Personal Finance Software for Your Financial Journey

So, how do you pick the winner? It really boils down to your personal financial situation, goals, and preferences. Here are some scenarios to help you decide:

If You're Just Starting Out or Want a Free Option for Budgeting

Mint is probably your best bet. It's free, easy to set up, and gives you a great bird's-eye view of your finances. You can connect all your accounts, see where your money is going, and set up basic budgets. It's a fantastic entry point into the world of financial management without any cost commitment. The automatic categorization is a huge time-saver, even if it sometimes needs a little tweaking. Plus, the credit score monitoring is a nice bonus.

If You're Serious About Changing Your Spending Habits and Mastering Budgeting

YNAB is the clear winner here. While it has a subscription fee, the value it provides in terms of financial discipline and awareness is often worth every penny. Its zero-based budgeting philosophy forces you to be intentional with every dollar, which can lead to significant savings and debt reduction. It's not just a tool; it's a system that helps you build better financial habits. Be prepared to invest some time in learning its methodology, but the payoff can be huge.

If You Have Complex Investments, Rental Properties, or Small Business Needs

Quicken remains the gold standard for comprehensive financial management. If you're tracking multiple investment accounts, managing rental income and expenses, or need robust tax reporting features, Quicken's desktop-first approach with its deep feature set is hard to beat. It's designed for those who need granular control and detailed reporting across all aspects of their financial life. The learning curve is steeper, but the power it offers is unmatched for complex scenarios.

If Your Primary Focus is Investment Tracking and Net Worth Growth

Personal Capital shines in this area. Its free dashboard is incredibly powerful for aggregating all your investment accounts, analyzing your portfolio's performance, identifying hidden fees, and planning for retirement. If you're an active investor or simply want a clear picture of your overall wealth, Personal Capital provides insights that other tools might miss. While it has some budgeting features, its strength truly lies in wealth management and investment analysis.

If You Want a Modern, Streamlined Budgeting Experience Without the Complexity

Simplifi by Quicken is an excellent choice. It takes the core strengths of Quicken's data aggregation but presents them in a much cleaner, more intuitive, and cloud-based interface. It's perfect if you want to focus on understanding your spending, managing your cash flow, and setting financial goals without getting bogged down by advanced investment features you might not need. It's a great middle-ground between the simplicity of Mint and the depth of full Quicken.

Tips for Maximizing Your Personal Finance Software Experience

Once you've chosen your software, here are some tips to get the most out of it:

- Connect All Your Accounts: The more accounts you link (checking, savings, credit cards, loans, investments), the more accurate and comprehensive your financial picture will be.

- Categorize Consistently: Take the time to review and adjust transaction categories. The better your categorization, the more insightful your reports will be.

- Set Realistic Budgets: Don't try to cut everything at once. Start with a realistic budget and adjust as you go. The goal is sustainability, not deprivation.

- Review Regularly: Make it a habit to check your software at least once a week. This helps you stay on top of your spending and make adjustments as needed.

- Set Financial Goals: Use the goal-setting features to motivate yourself. Whether it's saving for a vacation, a down payment, or retirement, seeing your progress can be incredibly motivating.

- Utilize Reports: Dive into the reports and analytics. They can reveal spending patterns you never knew you had and help you identify areas for improvement.

- Stay Secure: Always use strong, unique passwords and enable multi-factor authentication if available. Your financial data is sensitive!

- Don't Be Afraid to Experiment: Many paid software options offer free trials. Take advantage of them to see which interface and features resonate most with you.

The Future of Personal Finance Software AI and Beyond

The landscape of personal finance software is constantly evolving. We're seeing more integration of Artificial Intelligence (AI) and machine learning to provide even more personalized insights. Imagine software that not only tracks your spending but also proactively suggests ways to save based on your habits, predicts future cash flow with greater accuracy, or even identifies potential financial risks before they become problems. Voice commands, deeper integration with other financial services, and even more intuitive user interfaces are all on the horizon. The goal is to make financial management as seamless and effortless as possible, empowering you to make smarter decisions with minimal effort.

Ultimately, the best personal finance software is the one you'll actually use consistently. It's a tool to help you achieve your financial goals, not a magic bullet. By choosing the right one for your needs and committing to regular use, you'll be well on your way to mastering your money and building a more secure financial future. Happy budgeting!

"article_id": "financial_technology_digital_finance_14" } ] }:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)