Best Practices for Retirement Investing

Implement best practices for retirement investing to ensure a secure and comfortable financial future.

Implement best practices for retirement investing to ensure a secure and comfortable financial future. Planning for retirement can feel like a monumental task, but with the right strategies and tools, it's entirely achievable. This guide will walk you through the best practices for retirement investing, helping you build a robust financial foundation for your golden years.

Best Practices for Retirement Investing

Retirement investing isn't just about saving money; it's about strategically growing your wealth so you can maintain your desired lifestyle long after you stop working. It's a marathon, not a sprint, and consistency is key. Let's dive into the core principles and actionable steps.

Start Early The Power of Compounding in Retirement Savings

One of the most powerful forces in finance is compound interest. The earlier you start investing, the more time your money has to grow, earning returns on both your initial investment and the accumulated interest. Even small, consistent contributions made early can lead to substantial wealth over decades. For example, a 25-year-old investing $300 per month at an average annual return of 7% could accumulate over $1 million by age 65. Waiting until 35 to start with the same contributions would yield significantly less, highlighting the immense benefit of early action.

Define Your Retirement Goals and Lifestyle Expectations

Before you can effectively invest, you need a clear picture of what retirement looks like for you. Do you envision extensive travel, pursuing hobbies, or simply enjoying a quiet life at home? Consider your expected expenses, including housing, healthcare, leisure, and potential long-term care. Tools like Fidelity's Retirement Planner or Vanguard's Retirement Nest Egg Calculator can help you estimate how much you'll need. These calculators often factor in inflation and your desired retirement age, providing a more realistic target.

Understand Your Risk Tolerance and Investment Horizon

Your risk tolerance is your comfort level with potential investment losses in exchange for higher returns. Generally, younger investors with a longer time horizon can afford to take on more risk, as they have more time to recover from market downturns. As you approach retirement, it's common to shift towards more conservative investments to protect your accumulated wealth. Online questionnaires from brokers like Charles Schwab or E*TRADE can help you assess your risk profile. Your investment horizon is simply the length of time you plan to invest before needing the money.

Diversify Your Portfolio Across Asset Classes

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket. A well-diversified portfolio typically includes a mix of stocks (equities), bonds (fixed income), and potentially real estate or other alternative investments. Stocks offer growth potential but come with higher volatility, while bonds provide stability and income. The specific allocation will depend on your risk tolerance and time horizon. For instance, a younger investor might have 80% stocks and 20% bonds, while someone nearing retirement might reverse that ratio.

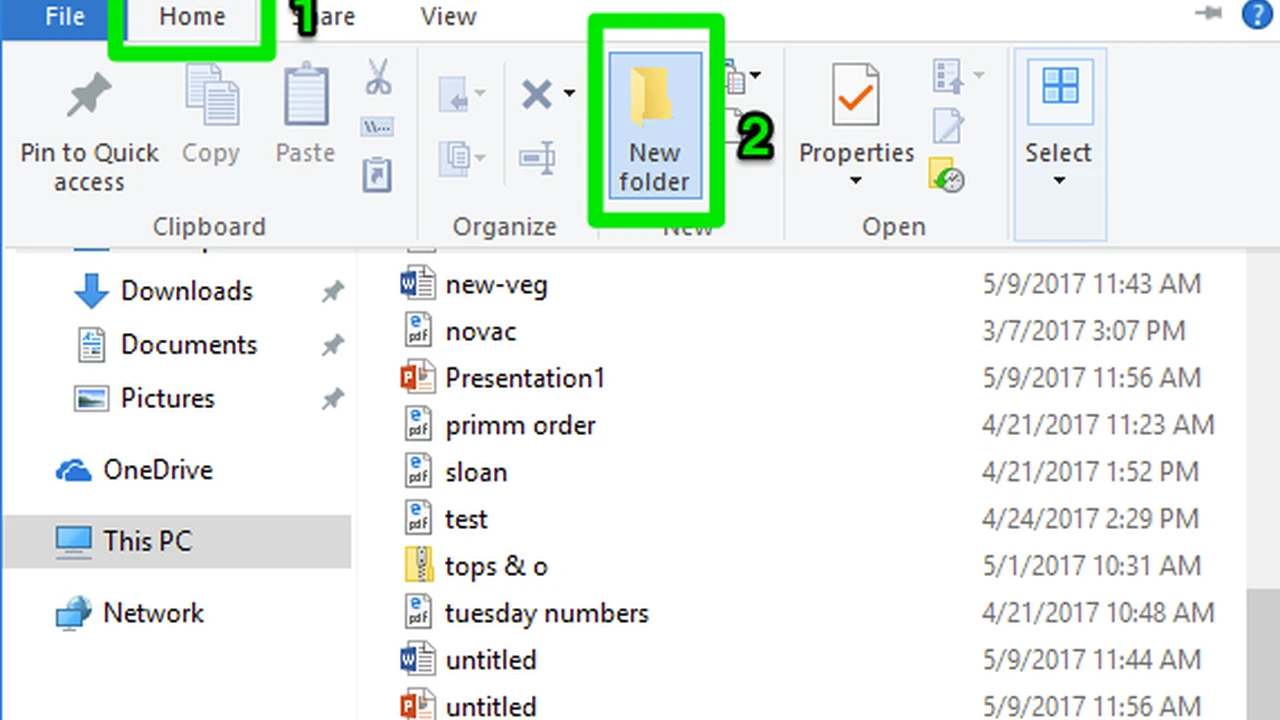

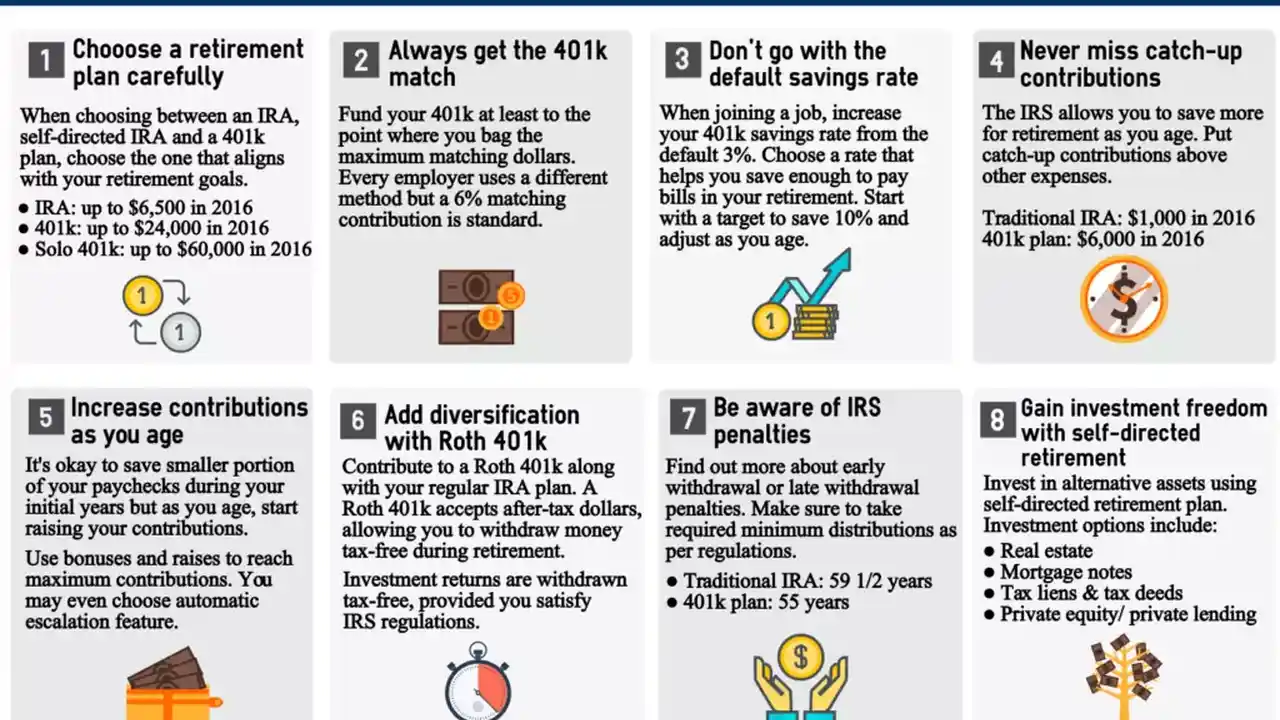

Utilize Tax-Advantaged Retirement Accounts 401k IRA Roth Options

Leveraging tax-advantaged accounts is one of the smartest moves you can make. These accounts offer significant tax benefits that can accelerate your wealth accumulation. Here are the primary options:

- 401(k) / 403(b): Employer-sponsored plans that allow pre-tax contributions, reducing your current taxable income. Many employers offer a matching contribution, which is essentially free money. Funds grow tax-deferred until withdrawal in retirement.

- Traditional IRA: Individual Retirement Arrangement. Contributions may be tax-deductible, and earnings grow tax-deferred. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA / Roth 401(k): Contributions are made with after-tax dollars, but qualified withdrawals in retirement are completely tax-free. This is particularly beneficial if you expect to be in a higher tax bracket in retirement.

Product Recommendations:

- Fidelity Go (Robo-Advisor): Ideal for beginners. It automatically manages your investments within a Roth IRA or Traditional IRA based on your risk profile. Fees are low, typically 0.35% of assets under management (AUM) for balances over $25,000, and no advisory fee for balances under $25,000.

- Vanguard Target Retirement Funds: These are excellent for hands-off investing within a 401(k) or IRA. They automatically adjust their asset allocation (stocks vs. bonds) as you get closer to your target retirement date. Expense ratios are very low, often around 0.08% to 0.15%.

- Schwab Intelligent Portfolios (Robo-Advisor): Offers automated investing with no advisory fees. You only pay for the expense ratios of the underlying ETFs. It's a great option for those who want diversified portfolios without active management.

Regularly Review and Rebalance Your Portfolio

Your investment portfolio isn't a set-it-and-forget-it endeavor. Market fluctuations can cause your asset allocation to drift from your target. Rebalancing involves selling some of your overperforming assets and buying more of your underperforming ones to bring your portfolio back to its desired allocation. This helps maintain your risk level and can even enhance returns. Aim to review and rebalance at least once a year, or when your allocation deviates significantly (e.g., by 5-10%).

Minimize Fees and Expenses The Impact on Long-Term Returns

Fees, even seemingly small ones, can significantly erode your long-term returns. Pay attention to expense ratios on mutual funds and ETFs, advisory fees, and trading commissions. Opt for low-cost index funds or ETFs over actively managed funds, which often have higher fees but don't consistently outperform the market. For example, a 1% difference in annual fees over 30 years can cost you tens of thousands of dollars in lost returns.

Avoid Emotional Investing Stay Disciplined Through Market Volatility

Market downturns can be unsettling, but making rash decisions based on fear or panic is often detrimental to your long-term goals. Stick to your investment plan, and remember that market corrections are a normal part of investing. Historically, markets have always recovered. Conversely, don't get overly exuberant during bull markets and take on excessive risk. Discipline and a long-term perspective are your best allies.

Consider Healthcare Costs in Retirement Planning

Healthcare is often one of the largest expenses in retirement. Medicare covers some costs, but it doesn't cover everything. Consider supplemental insurance, long-term care insurance, or a Health Savings Account (HSA) if you're eligible. HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. They can be a powerful tool for retirement healthcare savings.

Plan for Inflation The Erosion of Purchasing Power

Inflation erodes the purchasing power of your money over time. What costs $100 today might cost $200 in 20 years. Your retirement savings need to grow at a rate that outpaces inflation to maintain your lifestyle. This is why investing in growth-oriented assets like stocks is important, especially in your earlier years, as they have historically provided returns that beat inflation.

Seek Professional Financial Advice When Needed

While this guide provides a solid foundation, complex financial situations or a lack of confidence might warrant professional help. A certified financial planner (CFP) can help you create a personalized retirement plan, optimize your investments, and navigate complex tax situations. Look for fee-only advisors who are fiduciaries, meaning they are legally obligated to act in your best interest.

Specific Financial Advisor Platforms:

- Personal Capital (now Empower Personal Wealth): Offers free financial tracking tools and paid advisory services. Their free dashboard is excellent for aggregating all your accounts in one place. Advisory fees typically range from 0.49% to 0.89% of AUM.

- Facet Wealth: Provides comprehensive financial planning for a flat annual fee, rather than a percentage of assets. This can be cost-effective for those with larger portfolios. Fees start around $2,400 per year.

- Garrett Planning Network: A network of fee-only financial advisors who charge by the hour or on a project basis, making it accessible for those who don't need ongoing management but want specific advice. Hourly rates vary by advisor, typically $150-$300 per hour.

Regularly Update Your Retirement Plan

Life changes, and so should your retirement plan. Major life events like marriage, having children, career changes, or unexpected expenses should prompt a review of your plan. Your goals, risk tolerance, and financial situation will evolve, and your plan needs to adapt accordingly to remain effective.

Consider a Phased Retirement or Part-Time Work

Retirement doesn't have to be an abrupt stop. Many people opt for a phased retirement, gradually reducing their work hours or transitioning to part-time roles. This can ease the transition, provide additional income, and allow your savings to continue growing for a longer period. It also helps bridge the gap until you can claim Social Security or other benefits.

Understand Social Security and Other Benefits

Social Security will likely be a component of your retirement income, but it's rarely enough to live on comfortably. Understand how your benefits are calculated, when you're eligible to claim them, and how claiming early or late can impact your monthly payments. The Social Security Administration website offers personalized estimates and resources. Also, explore any pension plans or other benefits you might be entitled to from previous employers.

Create an Estate Plan

While not directly about investing, an estate plan is a crucial part of comprehensive retirement planning. It ensures your assets are distributed according to your wishes, minimizes taxes for your heirs, and designates power of attorney for financial and healthcare decisions. This provides peace of mind for you and your loved ones.

Stay Healthy and Active

Your health is your wealth, especially in retirement. Maintaining a healthy lifestyle can reduce healthcare costs and allow you to enjoy your retirement years to the fullest. Factor in wellness activities and potential health-related expenses into your retirement budget.

By consistently applying these best practices, you'll be well on your way to building a secure and comfortable financial future. Remember, every small step you take today contributes to a more prosperous tomorrow.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)