The Ultimate Guide to Understanding Your Credit Report

A comprehensive guide to interpreting your credit report and identifying areas for improvement.

A comprehensive guide to interpreting your credit report and identifying areas for improvement.

The Ultimate Guide to Understanding Your Credit Report

What is a Credit Report and Why Does it Matter?

Ever wondered what lenders look at when you apply for a loan, a new credit card, or even an apartment? Chances are, they're pulling your credit report. Think of your credit report as your financial resume. It's a detailed summary of your credit history, showing how you've managed your debts over time. This document is crucial because it directly influences your credit score, which in turn affects your ability to borrow money, the interest rates you'll pay, and even your insurance premiums. Understanding your credit report isn't just about knowing your numbers; it's about empowering yourself to make better financial decisions and protect yourself from potential fraud.

The Big Three: Experian, Equifax, and TransUnion Explained

In the United States, there are three major credit bureaus: Experian, Equifax, and TransUnion. These are the companies that collect and maintain your credit information. While they all gather similar data, their reports might not be identical. Why? Because not all lenders report to all three bureaus. One lender might report to Experian and TransUnion, while another reports only to Equifax. This is why it's super important to check your report from all three. You're entitled to a free copy of your credit report from each of these bureaus once every 12 months through AnnualCreditReport.com. Don't fall for look-alike sites; AnnualCreditReport.com is the only authorized source for your free reports.

Key Sections of Your Credit Report: A Deep Dive

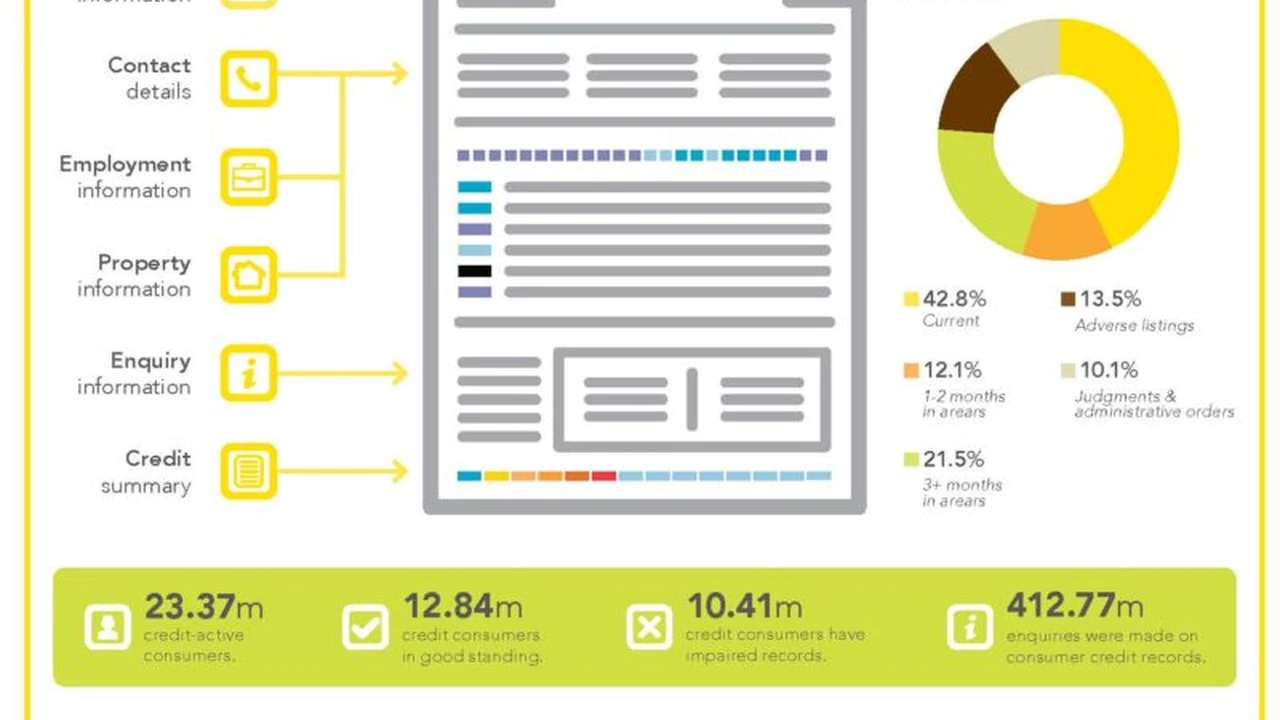

Your credit report is broken down into several sections, each providing a different piece of your financial puzzle. Let's break them down:

Personal Information: Ensuring Accuracy for Your Credit Profile

This section includes your name, current and previous addresses, Social Security number, date of birth, and employment information. It's vital that this information is accurate. Incorrect personal details could lead to mixed files with someone else's credit history or make it harder for lenders to verify your identity.

Credit Accounts: Your Payment History and Debt Obligations

This is arguably the most important part. It lists all your credit accounts, including credit cards, mortgages, auto loans, student loans, and personal loans. For each account, you'll see:

- Account Type: Revolving (like credit cards) or Installment (like mortgages).

- Creditor Name: Who you owe money to.

- Account Number: Often partially masked for security.

- Date Opened: When the account was established.

- Credit Limit or Loan Amount: The maximum you can borrow or the original loan amount.

- Current Balance: How much you currently owe.

- Payment Status: Whether payments are current, past due, or if the account is closed.

- Payment History: A month-by-month record of your payments, showing if they were on time or late. This is where late payments really stand out.

Public Records: Bankruptcies, Liens, and Judgments on Your Credit

This section includes information from public sources, such as bankruptcies, tax liens, and civil judgments. While some public record items like civil judgments and tax liens are no longer included in credit reports from Experian, Equifax, and TransUnion due to changes in reporting standards, bankruptcies still appear and can significantly impact your credit score for many years.

Inquiries: Who's Looking at Your Credit?

Whenever you apply for new credit, a lender pulls your credit report. This is called an inquiry. There are two types:

- Hard Inquiries: These occur when you apply for new credit (e.g., a loan, credit card, mortgage). They can slightly lower your credit score for a short period (usually up to two years). Too many hard inquiries in a short time can signal to lenders that you're a higher risk.

- Soft Inquiries: These happen when you check your own credit report, when a lender pre-approves you for an offer, or for employment verification. Soft inquiries do not affect your credit score.

Decoding Your Credit Score: FICO vs VantageScore

While your credit report is the raw data, your credit score is a numerical representation of that data. The two most common scoring models are FICO and VantageScore. Both range from 300 to 850, with higher scores indicating lower risk.

- FICO Score: This is the most widely used credit score. It considers five main factors: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

- VantageScore: Developed by the three major credit bureaus, VantageScore also uses similar factors but might weigh them slightly differently. It's gaining popularity and is often provided for free by credit card companies or financial institutions.

It's important to remember that you have many different credit scores, as different lenders use different versions of these models. The score you see might not be the exact score a lender sees, but it will be in the same general range.

Common Errors on Credit Reports and How to Fix Them

Mistakes on credit reports are more common than you might think, and they can seriously hurt your credit score. Here are some common errors:

- Incorrect Personal Information: Wrong name, address, or Social Security number.

- Accounts You Don't Own: This could be a sign of identity theft.

- Incorrect Account Status: An account reported as open when it's closed, or a late payment reported when you paid on time.

- Duplicate Accounts: The same account listed multiple times.

- Incorrect Balances or Credit Limits: These can impact your credit utilization ratio.

Disputing Errors: Your Rights and the Process

If you find an error, you have the right to dispute it with the credit bureau. Here's how:

- Get Your Reports: Obtain your free credit reports from all three bureaus at AnnualCreditReport.com.

- Identify Errors: Carefully review each section for inaccuracies.

- Gather Documentation: Collect any evidence that supports your claim (e.g., payment receipts, bank statements, canceled checks).

- Initiate a Dispute: You can dispute online, by mail, or by phone. Online is often the quickest. Provide clear details about the error and include your supporting documents.

- Follow Up: The credit bureau has 30-45 days to investigate. They will contact the creditor to verify the information. If the information is found to be inaccurate, it must be removed or corrected.

If the credit bureau doesn't resolve the issue to your satisfaction, you can also dispute directly with the creditor that reported the information.

Protecting Your Credit: Identity Theft and Fraud Prevention

Your credit report is a prime target for identity thieves. Regularly checking your report is one of the best ways to spot suspicious activity early. Here are some tips:

- Monitor Your Accounts: Regularly review your bank and credit card statements for unauthorized transactions.

- Use Strong Passwords: For all your online financial accounts.

- Be Wary of Phishing Scams: Don't click on suspicious links or provide personal information in response to unsolicited emails or calls.

- Shred Documents: Before discarding any documents containing personal or financial information.

- Consider a Credit Freeze: This is the strongest protection against new account identity theft. A credit freeze restricts access to your credit report, preventing new credit from being opened in your name. You can freeze and unfreeze your credit for free with each of the three major credit bureaus.

Tools and Services to Help You Monitor Your Credit

While AnnualCreditReport.com gives you free annual reports, many services offer more frequent monitoring and additional features. Here are a few popular options, keeping in mind that features and pricing can change:

Credit Karma: Free Credit Scores and Monitoring

Overview: Credit Karma is a very popular free service that provides your VantageScore 3.0 scores from TransUnion and Equifax, along with credit reports from those bureaus. It offers daily credit monitoring, alerts for significant changes, and personalized recommendations for credit cards and loans based on your credit profile. Key Features: Free credit scores (VantageScore), credit report monitoring, credit factor analysis, debt repayment calculators, identity monitoring, and personalized product recommendations. Pros: Completely free, easy to use, provides valuable insights into your credit, and offers identity monitoring. Cons: Uses VantageScore, which isn't always what lenders use (most use FICO). Recommendations can be overwhelming. Usage Scenario: Excellent for anyone wanting to keep a regular eye on their credit without paying a fee. Great for understanding the factors impacting your score and getting tailored financial product suggestions.

Experian: Free FICO Score and Credit Report Access

Overview: Experian offers a free service that provides your Experian FICO Score 8, along with access to your Experian credit report. They also offer paid premium services with more features. Key Features: Free FICO Score (Experian version), Experian credit report access, credit monitoring, FICO score tracking, and educational resources. Pros: Provides a FICO score, which is widely used by lenders. Direct access to one of your three credit reports. Cons: Only provides data from Experian for the free version. Full features require a paid subscription. Usage Scenario: Ideal for those who want to track their FICO score specifically and get direct insights from one of the major bureaus.

MyFICO: Comprehensive FICO Score Access

Overview: MyFICO is the consumer-facing arm of FICO, offering access to various FICO score versions used by different lenders (e.g., FICO Score 2, 4, 5 for mortgages; FICO Score 8, 9 for general lending). It's a paid service, but it provides the most comprehensive look at your FICO scores. Key Features: Access to multiple FICO score versions, credit reports from all three bureaus, credit monitoring, identity theft protection, and score simulators. Pros: Provides the most accurate and diverse range of FICO scores. Excellent for understanding how different lenders view your credit. Cons: It's a paid service, which can be a barrier for some. Pricing varies based on the plan chosen (e.g., Basic, Premier, Ultimate). Usage Scenario: Best for individuals who are about to make a significant financial move (like buying a home or car) and want to know exactly which FICO score versions lenders will see. Also great for those who want the most in-depth credit analysis.

Identity Guard: Robust Identity Theft Protection with Credit Monitoring

Overview: Identity Guard is primarily an identity theft protection service that includes robust credit monitoring as part of its offerings. They monitor your credit reports, public records, and the dark web for suspicious activity. Key Features: 3-bureau credit monitoring, FICO score tracking, identity theft insurance, dark web monitoring, lost wallet protection, and U.S.-based identity restoration specialists. Pros: Comprehensive identity theft protection. Monitors all three bureaus. Offers significant identity theft insurance. Cons: More expensive than basic credit monitoring services. Credit score reporting might not be as detailed as MyFICO. Usage Scenario: For individuals who are highly concerned about identity theft and want an all-in-one solution that includes credit monitoring and strong protection features. Pricing typically ranges from around $7.50 to $25 per month, depending on the plan and whether it's individual or family coverage.

Credit Sesame: Free Credit Score and Debt Management Tools

Overview: Similar to Credit Karma, Credit Sesame offers a free VantageScore and credit report card. It focuses heavily on helping users manage and reduce debt, offering personalized recommendations for loans and credit cards. Key Features: Free VantageScore, credit report card, debt analysis, personalized loan and credit card recommendations, and identity theft protection. Pros: Free service, good for debt management insights, offers identity theft protection. Cons: Uses VantageScore, not FICO. Recommendations can be pushy. Usage Scenario: Good for those looking for free credit monitoring with a focus on debt reduction strategies and personalized financial product offers.

Improving Your Credit: Actionable Steps for a Healthier Financial Future

Understanding your credit report is the first step; improving it is the next. Here are some actionable steps:

- Pay Your Bills On Time: This is the single most important factor. Even one late payment can significantly drop your score. Set up automatic payments or reminders.

- Keep Credit Utilization Low: This refers to how much of your available credit you're using. Aim to keep it below 30% on all your credit cards. Lower is better.

- Don't Close Old Accounts: Older accounts with good payment history contribute positively to your length of credit history. Closing them can shorten your average account age.

- Diversify Your Credit Mix: Having a mix of different types of credit (e.g., credit cards, installment loans) can be beneficial, but only if you can manage them responsibly.

- Limit New Credit Applications: Each hard inquiry can slightly lower your score. Only apply for credit when you truly need it.

- Address Derogatory Marks: If you have collections or charge-offs, try to negotiate a pay-for-delete or settle the debt. While they won't disappear immediately, resolving them shows good faith.

Your Credit Report and Your Future: Beyond Loans

Your credit report and score impact more than just your ability to get a loan. Landlords often check credit reports when you apply for an apartment. Some employers, especially for positions involving financial responsibility, may review your credit report (with your permission). Insurance companies may use credit-based insurance scores to determine your premiums. Even utility companies might check your credit before setting up service. This highlights just how pervasive your credit health is in various aspects of your life. By regularly reviewing your credit report and actively working to improve it, you're not just preparing for future borrowing; you're building a stronger foundation for your overall financial well-being.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)