Comparing Balance Transfer Cards for Credit Card Debt

Understand the benefits and drawbacks of various balance transfer credit cards for managing and reducing credit card debt.

Comparing Balance Transfer Cards for Credit Card Debt

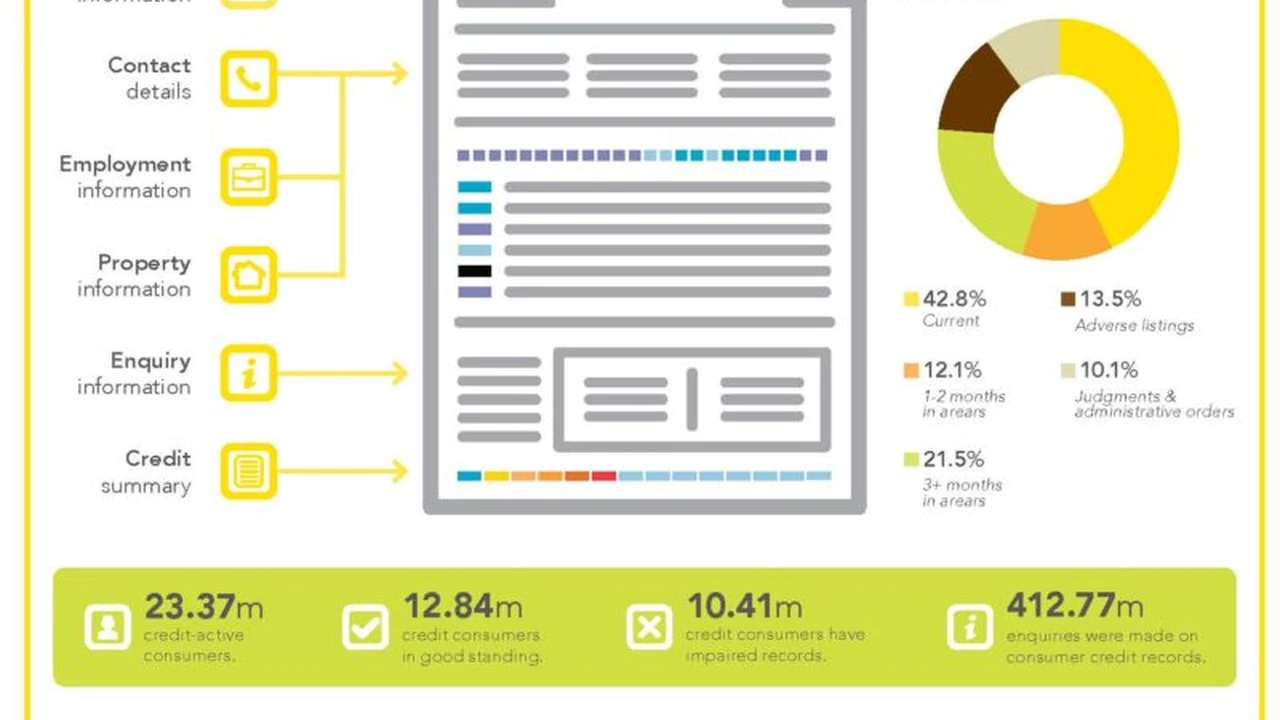

Credit card debt can feel like a heavy burden, a relentless cycle of high interest rates making it hard to pay down the principal. If you're nodding along, a balance transfer credit card might just be the financial lifeline you've been searching for. These cards offer a way to consolidate your existing high-interest credit card debt onto a new card, often with an introductory 0% Annual Percentage Rate (APR) for a set period. This can give you a crucial window of time to pay down your debt without the added pressure of accumulating interest. But with so many options out there, how do you pick the right one? Let's dive deep into comparing balance transfer cards, looking at their benefits, drawbacks, and specific products that might fit your situation.

What is a Balance Transfer Card and How Does it Work?

At its core, a balance transfer card is a credit card designed to help you move debt from one or more existing credit cards to a new one. The main appeal is the introductory 0% APR period, which can range from 6 to 21 months, sometimes even longer. During this period, every dollar you pay goes directly towards reducing your principal balance, rather than being eaten up by interest charges. Once the introductory period ends, a standard variable APR will apply to any remaining balance.

Here's a simplified breakdown of how it works:

- You apply for a new balance transfer credit card.

- If approved, you request to transfer balances from your existing high-interest credit cards to the new card.

- A balance transfer fee, typically 3% to 5% of the transferred amount, is usually charged. This fee is added to your new balance.

- You then make regular payments on your new card, focusing on paying down the principal during the 0% APR period.

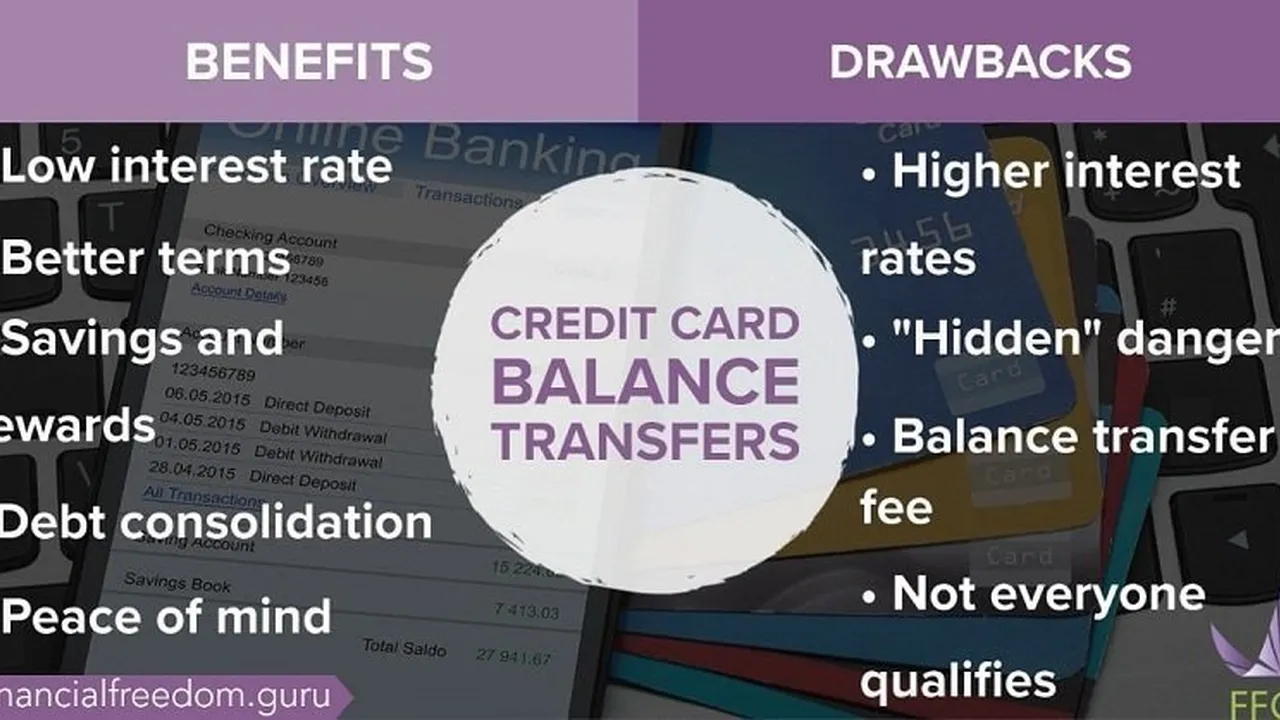

Key Benefits of Using a Balance Transfer Card for Debt Management

Using a balance transfer card can offer several significant advantages when you're trying to get a handle on your credit card debt:

Saving Money on Interest Payments

This is arguably the biggest benefit. By eliminating interest for several months, you can save hundreds or even thousands of dollars, depending on your debt amount and original interest rates. Imagine having an extra $50 or $100 each month that used to go to interest now going directly to your principal. That's real progress!

Simplifying Your Debt Repayment Strategy

Instead of juggling multiple credit card payments with different due dates and interest rates, a balance transfer consolidates everything into one monthly payment. This makes it much easier to track your progress and manage your finances, reducing the mental load of debt.

Accelerating Your Debt Payoff Timeline

With no interest accruing during the promotional period, you can pay down your debt much faster. If you commit to making consistent, larger-than-minimum payments, you might even be able to pay off the entire transferred balance before the 0% APR period expires, becoming completely debt-free on that amount.

Potential for Credit Score Improvement

While a new credit inquiry might temporarily ding your score, successfully paying down debt can positively impact your credit utilization ratio (the amount of credit you're using compared to your total available credit). A lower utilization ratio is generally good for your credit score. Plus, making on-time payments consistently on your new card will also help build a positive payment history.

Potential Drawbacks and Considerations for Balance Transfers

While balance transfer cards offer a powerful tool for debt relief, they're not without their downsides. It's crucial to understand these before committing:

Balance Transfer Fees and Their Impact

Most balance transfer cards charge a fee, typically 3% to 5% of the amount transferred. For example, transferring $5,000 with a 3% fee means you'll pay an additional $150. This fee is usually added to your new balance, so factor it into your total debt. While it might seem like a lot, it's often significantly less than the interest you'd pay over several months on a high-APR card.

The Importance of the Introductory APR Period

The 0% APR period is a temporary reprieve. If you don't pay off the transferred balance before it expires, any remaining debt will be subject to the card's standard variable APR, which can be quite high. This is why having a solid repayment plan is essential.

Impact on Your Credit Score and New Credit Inquiries

Applying for a new credit card results in a hard inquiry on your credit report, which can slightly lower your score for a short period. Additionally, opening a new account can temporarily reduce the average age of your credit accounts, another factor in your credit score. However, the long-term benefits of debt reduction often outweigh these short-term impacts.

The Risk of Accumulating New Debt

This is perhaps the biggest danger. If you transfer a balance and then continue to use your old credit cards or run up new debt on the balance transfer card, you could end up in a worse financial position than when you started. The goal is to pay down debt, not just move it around or add to it. It's often recommended to cut up the old cards or freeze them to avoid temptation.

Credit Limit Considerations for Balance Transfers

The credit limit you're approved for on the new balance transfer card might not be high enough to cover all your existing debt. Lenders assess your creditworthiness, and if your debt-to-income ratio is already high, you might receive a lower limit than you hoped for. This means you might only be able to transfer a portion of your debt.

Choosing the Right Balance Transfer Card for Your Needs

Selecting the best balance transfer card depends on your specific financial situation and goals. Here are the key factors to consider:

Length of the 0% APR Introductory Period

This is crucial. The longer the 0% APR period, the more time you have to pay down your debt interest-free. Look for cards offering 15, 18, or even 21 months if possible. Calculate how much you can realistically pay each month and see if you can pay off the entire balance within that timeframe.

Balance Transfer Fee Percentage

While most cards have a fee, some occasionally offer no-fee balance transfers. These are rare but highly valuable if you can find one. Otherwise, compare the fees (typically 3% to 5%) and factor them into your decision. A lower fee means more of your payment goes to the principal.

Regular APR After the Promotional Period

Even if you plan to pay off the debt before the 0% APR expires, it's wise to know what the regular APR will be. If you don't manage to pay it all off, you'll want a reasonable rate on the remaining balance. This rate will vary based on your creditworthiness.

Credit Score Requirements for Approval

Balance transfer cards typically require good to excellent credit (generally FICO scores of 670 or higher). If your score is lower, you might have fewer options or be approved for a lower credit limit. Check your credit score before applying to gauge your eligibility.

Additional Card Features and Benefits

While the primary goal is debt reduction, some balance transfer cards also offer rewards programs (cash back, points, miles). However, be cautious: don't let the allure of rewards distract you from your main objective of paying down debt. Using the card for new purchases can quickly negate the benefits of the 0% APR.

Top Balance Transfer Card Recommendations and Use Cases

Let's look at some popular balance transfer cards and discuss their ideal use cases. Please note that specific offers, APRs, and fees can change, so always check the issuer's official website for the most current information.

Citi Simplicity Card: Longest 0% APR Period

Ideal for: Those who need a very long time to pay off a significant balance and want to avoid late fees.

The Citi Simplicity Card is often lauded for its exceptionally long 0% intro APR period on balance transfers, sometimes up to 21 months. It also boasts no late fees and no penalty APR, which can be a huge relief if you occasionally miss a payment (though you should always strive to pay on time). The balance transfer fee is typically 3% or 5%.

Use Case: You have a large credit card balance ($5,000+) and estimate you'll need 18-24 months to pay it off comfortably. You're disciplined enough to make consistent payments and won't be tempted to use the card for new purchases. The lack of late fees provides a small safety net, but remember, missing payments can still hurt your credit score.

Estimated Cost (Example): Transfer $5,000 with a 3% fee = $150 fee. Total balance $5,150. If you pay $245.24/month for 21 months, you'll pay it off interest-free. If you only pay $100/month, you'll still owe $3,050 after 21 months, which will then accrue interest at the standard APR (e.g., 19.99% - 29.99% variable).

Discover it Balance Transfer: Rewards and 0% APR

Ideal for: Those who want a solid 0% APR period and appreciate earning cash back on new purchases (if they can resist using the card for new spending).

The Discover it Balance Transfer card typically offers a 0% intro APR on balance transfers for 15-18 months, and also on new purchases for 6 months. It earns 5% cash back on rotating bonus categories each quarter (on up to a quarterly maximum, then 1%) and 1% cash back on all other purchases. Discover also matches all the cash back you've earned at the end of your first year for new cardmembers.

Use Case: You have a moderate balance ($2,000-$4,000) that you're confident you can pay off within 15-18 months. You're also looking for a card that can serve as a good everyday rewards card *after* you've paid off your transferred balance. The balance transfer fee is usually 3%.

Estimated Cost (Example): Transfer $3,000 with a 3% fee = $90 fee. Total balance $3,090. If you pay $206/month for 15 months, you'll pay it off interest-free. If you use it for new purchases, be extremely careful not to carry a balance on those, as the 0% purchase APR is shorter, and any new purchases could make it harder to pay off your transferred debt.

Chase Slate Edge: No Balance Transfer Fee (Intro Offer)

Ideal for: Those who prioritize avoiding the balance transfer fee and have excellent credit.

The Chase Slate Edge card often features an introductory offer of a $0 balance transfer fee for transfers made within the first 60 days of account opening. After that, a 3% or 5% fee applies. It also offers a 0% intro APR on balance transfers and purchases for a competitive period (e.g., 15-18 months). A unique feature is the potential for an automatic APR reduction by 2% each year you spend at least $1,000 and pay on time, down to a certain minimum.

Use Case: You have excellent credit and want to save on the balance transfer fee, even if it means a slightly shorter 0% APR period compared to some competitors. You're confident you can make the transfer within the initial 60-day window. This card is also good if you anticipate needing a lower APR long-term for any remaining balance.

Estimated Cost (Example): Transfer $4,000 with a $0 fee (if done within 60 days). Total balance $4,000. If you pay $266.67/month for 15 months, you'll pay it off interest-free. This saves you $120-$200 in fees compared to other cards.

BankAmericard Credit Card: Solid 0% APR and No Rewards

Ideal for: Individuals who want a straightforward balance transfer card with a good 0% APR period and no distractions from rewards.

The BankAmericard Credit Card typically offers a competitive 0% intro APR on balance transfers and purchases for a period like 15-18 months. It has a standard balance transfer fee (usually 3% or 5%). What sets it apart for some is its simplicity – it doesn't offer a rewards program, which can be a benefit for those who want to focus solely on debt repayment without the temptation to spend.

Use Case: You are highly focused on debt elimination and want a clear path to paying down your balance without any incentives to make new purchases. You have a clear repayment plan and just need the interest-free window to execute it.

Estimated Cost (Example): Transfer $6,000 with a 3% fee = $180 fee. Total balance $6,180. If you pay $343.33/month for 18 months, you'll pay it off interest-free. This card is a workhorse for debt reduction.

Wells Fargo Reflect Card: Extended 0% APR Potential

Ideal for: Those who need a very long runway to pay off debt and are diligent about making on-time payments.

The Wells Fargo Reflect Card offers a very attractive 0% intro APR for 18 months from account opening, and this can be extended for an additional 3 months if you make your minimum payments on time during the introductory period. This means a potential total of 21 months of 0% APR. It has a balance transfer fee of 5% (minimum $5).

Use Case: You have a substantial amount of debt and need the absolute longest possible 0% APR period to tackle it. You are confident in your ability to make all minimum payments on time to unlock the full 21-month period. The higher balance transfer fee is a trade-off for the extended interest-free window.

Estimated Cost (Example): Transfer $7,000 with a 5% fee = $350 fee. Total balance $7,350. If you pay $350/month for 21 months, you'll pay it off interest-free. This card is designed for maximum interest savings over a long period.

Strategies for Maximizing Your Balance Transfer Card Benefits

Getting a balance transfer card is just the first step. To truly make it work for you, you need a solid strategy:

Create a Detailed Debt Repayment Plan

Before you even apply, calculate how much you need to pay each month to clear your transferred balance before the 0% APR period ends. Divide your total transferred balance (including the fee) by the number of months in your promotional period. This is your target monthly payment. Stick to it religiously.

Avoid New Purchases on the Balance Transfer Card

This is critical. Many balance transfer cards offer a 0% APR on purchases as well, but often for a shorter period. Even if they don't, making new purchases on the card can complicate your repayment efforts and potentially lead to interest charges on those new purchases if you don't pay them off in full each month (due to how payments are allocated).

Consider Closing Old Credit Card Accounts (Carefully)

Once your balances are transferred, consider closing the old accounts to remove temptation. However, be aware that closing accounts can sometimes negatively impact your credit utilization ratio and the average age of your credit accounts. A better strategy might be to simply put them away, freeze them, or cut them up, but keep the accounts open with a zero balance.

Set Up Automatic Payments to Avoid Missed Deadlines

Missing a payment can be costly. Not only can it incur late fees, but some cards will revoke your 0% APR if you miss a payment, immediately applying the standard variable APR to your entire balance. Set up automatic minimum payments to ensure you never miss a due date, and then manually pay extra towards your principal.

Monitor Your Progress and Stay Motivated

Regularly check your balance and celebrate milestones. Seeing your debt shrink can be incredibly motivating. Stay focused on your goal of becoming debt-free.

When a Balance Transfer Might Not Be the Best Option

While powerful, balance transfers aren't a universal solution. Here are scenarios where they might not be the best fit:

If Your Credit Score is Low

If your credit score is poor, you might not qualify for the best balance transfer offers, or any at all. Lenders are looking for low-risk borrowers. In this case, focusing on improving your credit score through consistent on-time payments and reducing existing debt (even if it means paying interest for a while) might be a better first step.

If You Cannot Commit to a Repayment Plan

A balance transfer is a tool, not a magic wand. If you don't have a disciplined plan to pay down the debt during the 0% APR period, you'll end up right back where you started, possibly with a higher balance due to the transfer fee, and then facing high interest rates again. If you struggle with overspending, addressing that behavior is paramount.

If Your Debt is Too Small or Too Large

For very small debts, the balance transfer fee might negate the interest savings. For extremely large debts, you might not get a high enough credit limit to transfer everything, or the monthly payments required to clear it during the 0% APR period might be unmanageable. In the latter case, other debt relief options like debt management plans or debt consolidation loans might be more appropriate.

If You Have a History of Missing Payments

As mentioned, missing a payment can trigger the immediate end of your 0% APR period. If you frequently miss payments, a balance transfer card could backfire significantly.

Alternative Debt Management Strategies to Consider

If a balance transfer isn't right for you, or if you need additional support, consider these alternatives:

Debt Consolidation Loans for Fixed Payments

A personal loan can be used to pay off multiple credit cards, leaving you with one fixed monthly payment at a potentially lower interest rate. Unlike balance transfer cards, the interest rate is fixed for the life of the loan, providing predictability. These are often available for a wider range of credit scores than the best balance transfer cards.

Debt Management Plans Through Credit Counseling

Non-profit credit counseling agencies can help you create a debt management plan (DMP). They negotiate with your creditors for lower interest rates and a single monthly payment. While you'll still pay interest, it's usually significantly reduced, and the agency handles the payments for you. This can be a good option if you have multiple high-interest debts and need structured support.

Negotiating with Creditors Directly for Lower Rates

Sometimes, simply calling your credit card companies and explaining your situation can lead to a temporary reduction in your interest rate or a more manageable payment plan. It doesn't always work, but it's worth a try, especially if you have a good payment history with that particular issuer.

The Debt Snowball or Debt Avalanche Method for Self-Management

These are self-managed strategies. The debt snowball method focuses on paying off your smallest debt first for psychological wins, while the debt avalanche method prioritizes paying off the debt with the highest interest rate first to save the most money. Both require discipline but can be very effective.

Final Thoughts on Balance Transfer Cards for Debt Relief

Balance transfer credit cards can be an incredibly effective tool for getting out of credit card debt, especially if you have good credit and a disciplined approach to repayment. The key is to use the 0% APR period wisely, focusing every extra dollar on paying down your principal. By understanding the benefits, drawbacks, and specific card options, you can make an informed decision that puts you on the path to financial freedom. Remember, it's not just about moving debt; it's about eliminating it.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)