Comparing Stocks vs Mutual Funds for Long-Term Growth

Understand the differences and benefits of investing in individual stocks versus diversified mutual funds for long-term growth.

Comparing Stocks vs Mutual Funds for Long-Term Growth

Hey there, future financial wizard! Ever wondered about the best way to grow your money over the long haul? You've probably heard about stocks and mutual funds, but what's the real deal with each of them? It's like choosing between a solo adventure and a guided tour – both can get you to your destination, but the journey is totally different. Let's dive deep into stocks versus mutual funds, breaking down their pros, cons, and when each might be your best bet for long-term wealth building.

Understanding Individual Stocks for Investment Growth

Alright, let's kick things off with individual stocks. When you buy a stock, you're essentially buying a tiny piece of a company. Think of it as becoming a part-owner. If that company does well, its stock price usually goes up, and you make money. If it struggles, the price can drop, and you might lose some cash. It's a direct relationship, and it can be super exciting!

The Allure of Direct Stock Ownership and Potential Returns

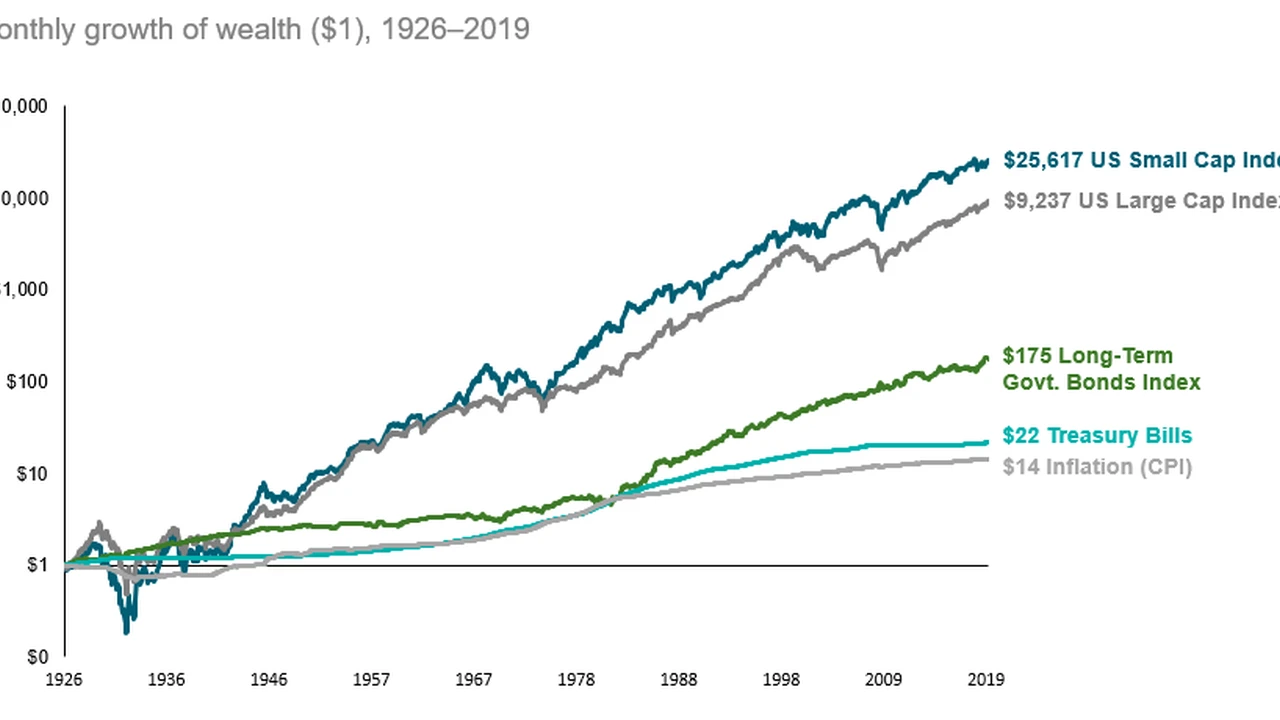

The biggest draw of individual stocks is the potential for high returns. If you pick the next Apple or Amazon early on, your investment could skyrocket. You have direct control over what you own, and you can react quickly to market news or company performance. This level of control and the thrill of picking winners can be really appealing to many investors.

Risks and Volatility in Stock Market Investing

But here's the flip side: individual stocks come with significant risk. If that one company you invested in hits a rough patch, your entire investment in that stock could take a nosedive. There's no diversification built-in; you're putting all your eggs in one basket, so to speak. This means you need to do a lot of research, stay updated on company news, and be prepared for potential volatility. It's not for the faint of heart or those who prefer a hands-off approach.

When to Consider Investing in Individual Stocks

So, when does it make sense to go all-in on individual stocks? Generally, it's for investors who:

- Have a high risk tolerance.

- Enjoy researching companies and understanding market trends.

- Have a significant amount of capital to diversify across many different stocks.

- Are looking for potentially higher returns and are comfortable with the associated risks.

- Are investing for the very long term, allowing time to ride out market fluctuations.

Exploring Mutual Funds for Diversified Portfolios

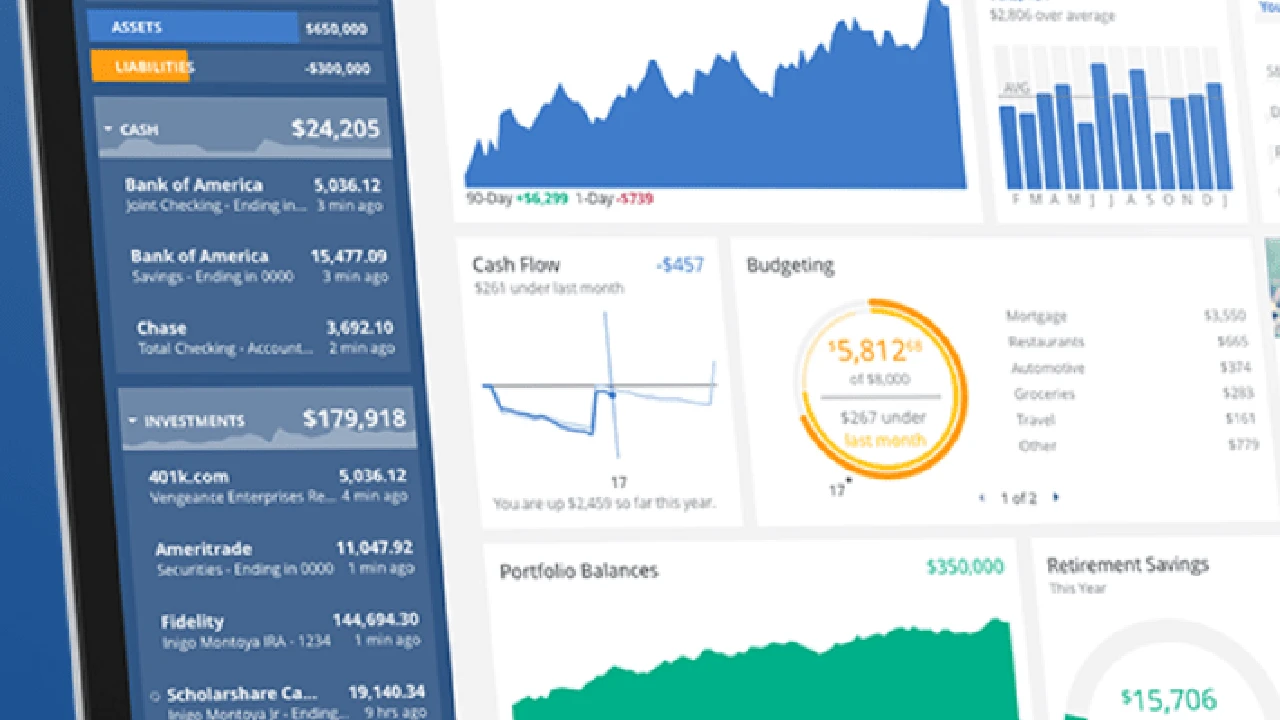

Now, let's shift gears to mutual funds. Imagine a giant pool of money collected from many different investors. This pool is then managed by a professional fund manager who uses that money to buy a diversified portfolio of stocks, bonds, or other securities. When you invest in a mutual fund, you're buying shares of this diversified portfolio.

The Power of Diversification and Professional Management

The key advantage of mutual funds is diversification. Instead of owning one or two stocks, you're instantly invested in dozens, hundreds, or even thousands of different securities. This spreads out your risk. If one company in the fund performs poorly, it's less likely to significantly impact your overall investment because of all the other holdings. Plus, you get professional management. These fund managers are experts who spend their days researching and making investment decisions, so you don't have to.

Understanding Mutual Fund Fees and Expense Ratios

Of course, professional management comes at a cost. Mutual funds typically charge fees, known as expense ratios. This is an annual percentage of your investment that goes towards covering the fund's operating expenses, including the manager's salary. These fees can eat into your returns over time, so it's crucial to pay attention to them. Some funds also have sales charges (loads) when you buy or sell shares.

When to Consider Investing in Mutual Funds

Mutual funds are often a great fit for investors who:

- Prefer a more hands-off approach to investing.

- Have a lower risk tolerance and want built-in diversification.

- Don't have the time or expertise to research individual stocks.

- Are looking for consistent, long-term growth with less volatility.

- Are just starting their investment journey and want a simpler entry point.

Key Differences: Stocks vs Mutual Funds for Long-Term Investors

Let's put them side-by-side to really highlight the differences:

Control and Decision-Making in Your Investment Strategy

With individual stocks, you're the boss. You decide exactly which companies to invest in, when to buy, and when to sell. With mutual funds, you hand over that control to the fund manager. You choose the fund, but the manager makes the day-to-day investment decisions within that fund's stated objectives.

Risk Exposure and Portfolio Diversification

This is a big one. Individual stocks expose you to company-specific risk. If that company fails, your investment is at high risk. Mutual funds, by their very nature, offer diversification, spreading your risk across many different assets. This generally leads to lower volatility compared to a portfolio of just a few individual stocks.

Costs and Fees Associated with Investing

When you buy individual stocks, your main costs are brokerage commissions (though many brokers now offer commission-free trading for stocks and ETFs). With mutual funds, you'll encounter expense ratios, and potentially sales loads. These ongoing fees can significantly impact your long-term returns, so always compare expense ratios when choosing funds.

Required Knowledge and Time Commitment for Research

Investing in individual stocks demands a significant time commitment for research, analysis, and monitoring. You need to understand financial statements, industry trends, and competitive landscapes. Mutual funds require less hands-on research once you've chosen a fund that aligns with your goals, as the professional manager handles the ongoing analysis.

Specific Product Recommendations and Use Cases

Okay, let's get practical. While I can't give personalized financial advice, I can give you some examples of popular platforms and funds that illustrate these concepts. Remember to always do your own research and consider your personal financial situation before making any investment decisions.

Top Platforms for Individual Stock Trading

If you're leaning towards individual stocks, you'll need a brokerage account. Here are a few popular options, often with commission-free trading for stocks:

- Fidelity: A long-standing giant, Fidelity offers a robust platform, extensive research tools, and a wide range of investment products. Great for both beginners and experienced traders.

- Charles Schwab: Similar to Fidelity, Schwab provides a comprehensive platform, excellent customer service, and a vast array of research resources.

- E*TRADE: Known for its user-friendly interface and powerful trading tools, E*TRADE is popular among active traders.

- Robinhood: Famous for pioneering commission-free trading and a very simple mobile app. It's great for beginners but might lack some of the advanced research tools of larger brokers.

- Interactive Brokers: Often preferred by professional and active traders due to its low costs and extensive trading capabilities across global markets.

Use Case for Individual Stocks: Let's say you're a tech enthusiast and you've done extensive research on a specific AI company, 'InnovateAI Corp.' You believe their new product will revolutionize the industry. You could open an account with Fidelity, deposit funds, and purchase shares of InnovateAI Corp. You'd then monitor their quarterly reports, news, and industry trends closely. This is a high-conviction play based on your specific research.

Popular Mutual Funds for Long-Term Growth

For mutual funds, you'll often find them offered by major investment firms. Here are some types and examples (note: specific fund performance and availability vary):

Index Funds (a type of mutual fund or ETF)

These are passively managed funds that aim to track a specific market index, like the S&P 500. They typically have very low expense ratios because they don't require active management.

- Vanguard S&P 500 Index Fund (VFIAX): This fund aims to track the performance of the S&P 500 index. It offers broad diversification across 500 of the largest U.S. companies. Expense Ratio: around 0.04%.

- Fidelity 500 Index Fund (FXAIX): Fidelity's equivalent to the S&P 500 index fund, also with a very low expense ratio. Expense Ratio: around 0.015%.

Use Case for Index Funds: You're a busy professional who wants broad market exposure and doesn't have time to pick individual stocks. You believe in the long-term growth of the U.S. economy. You could invest regularly in VFIAX through your brokerage account. This provides instant diversification and a low-cost way to participate in the stock market's overall growth.

Actively Managed Growth Funds

These funds are managed by professionals who actively try to pick stocks that they believe will outperform the market. They often have higher expense ratios due to the active management.

- American Funds Growth Fund of America (AGTHX): A very popular and long-standing actively managed fund focusing on growth stocks. Expense Ratio: around 0.62%.

- T. Rowe Price Growth Stock Fund (PRGFX): Another well-regarded actively managed fund seeking long-term capital appreciation. Expense Ratio: around 0.65%.

Use Case for Actively Managed Growth Funds: You want professional stock-picking expertise and believe a skilled manager can beat the market. You're willing to pay a higher fee for this potential outperformance. You might invest in AGTHX, trusting the fund managers to identify promising growth companies.

Target-Date Funds

These are mutual funds that automatically adjust their asset allocation over time, becoming more conservative as you approach a specific retirement year (the 'target date'). They are a 'set it and forget it' option.

- Vanguard Target Retirement 2050 Fund (VFIFX): Designed for someone planning to retire around 2050. It holds a mix of stocks and bonds that gradually shifts over time. Expense Ratio: around 0.08%.

- Fidelity Freedom Index 2040 Fund (FBIFX): Similar to Vanguard's offering, this fund adjusts its asset allocation based on the target retirement year. Expense Ratio: around 0.12%.

Use Case for Target-Date Funds: You're saving for retirement and want a single fund that handles all the asset allocation and rebalancing for you. You pick the fund closest to your expected retirement year, like VFIFX if you plan to retire around 2050, and simply contribute regularly.

Making Your Investment Choice: A Personalized Approach

So, which one is right for you? There's no single 'best' answer; it really depends on your individual circumstances, goals, and personality.

Assessing Your Risk Tolerance and Investment Horizon

First, be honest about your risk tolerance. Can you stomach seeing your investment drop by 20% or more in a short period? If not, individual stocks might cause too much stress. Also, consider your investment horizon. For long-term goals (5+ years), both can work, but the longer your horizon, the more time you have to recover from market downturns, making individual stocks potentially more viable if you're comfortable with the risk.

Considering Your Time Availability and Financial Knowledge

How much time are you willing to dedicate to managing your investments? If you love diving into financial reports and market news, individual stocks could be a rewarding hobby. If you'd rather spend your weekends doing anything but, mutual funds offer a convenient, professionally managed solution. Your current financial knowledge also plays a role; mutual funds are generally more beginner-friendly.

Building a Balanced Portfolio with Both Options

Here's a secret: you don't have to choose just one! Many investors build a diversified portfolio that includes both mutual funds (especially low-cost index funds for core diversification) and a smaller portion dedicated to individual stocks for higher-conviction plays. This 'core-satellite' approach allows you to benefit from broad market exposure while still having the potential for higher returns from specific stock picks.

For example, you might put 70-80% of your investment capital into a low-cost S&P 500 index fund (like VFIAX) for stable, diversified growth. Then, with the remaining 20-30%, you could pick a few individual stocks that you've thoroughly researched and believe have significant upside potential. This way, you get the best of both worlds: broad market exposure with professional management for the bulk of your money, and the excitement and potential higher returns of individual stock picking for a smaller, more speculative portion.

Ultimately, the goal is to find an investment strategy that you understand, feel comfortable with, and can stick with for the long term. Whether you go all-in on individual stocks, rely solely on mutual funds, or create a hybrid approach, consistency and patience are your best friends on the path to long-term financial growth. Happy investing!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)