The Ultimate Guide to Peer-to-Peer Lending

A comprehensive guide to understanding and participating in peer-to-peer lending for both borrowers and investors.

A comprehensive guide to understanding and participating in peer-to-peer lending for both borrowers and investors.

The Ultimate Guide to Peer-to-Peer Lending

Hey there, future financial wizard! Ever heard of peer-to-peer lending, or P2P as the cool kids call it? If not, you're in for a treat. This isn't your grandma's banking. P2P lending is basically a direct connection between people who want to borrow money and people who want to lend it, all without a traditional bank in the middle. Think of it like a dating app, but for money. It's been around for a while now, gaining serious traction because it often offers better rates for borrowers and higher returns for investors compared to traditional options. So, whether you're looking to get a loan for that dream renovation or you're an investor hunting for a new income stream, P2P lending might just be your next big thing. Let's dive in and explore everything you need to know.

What is Peer-to-Peer Lending Understanding the Basics

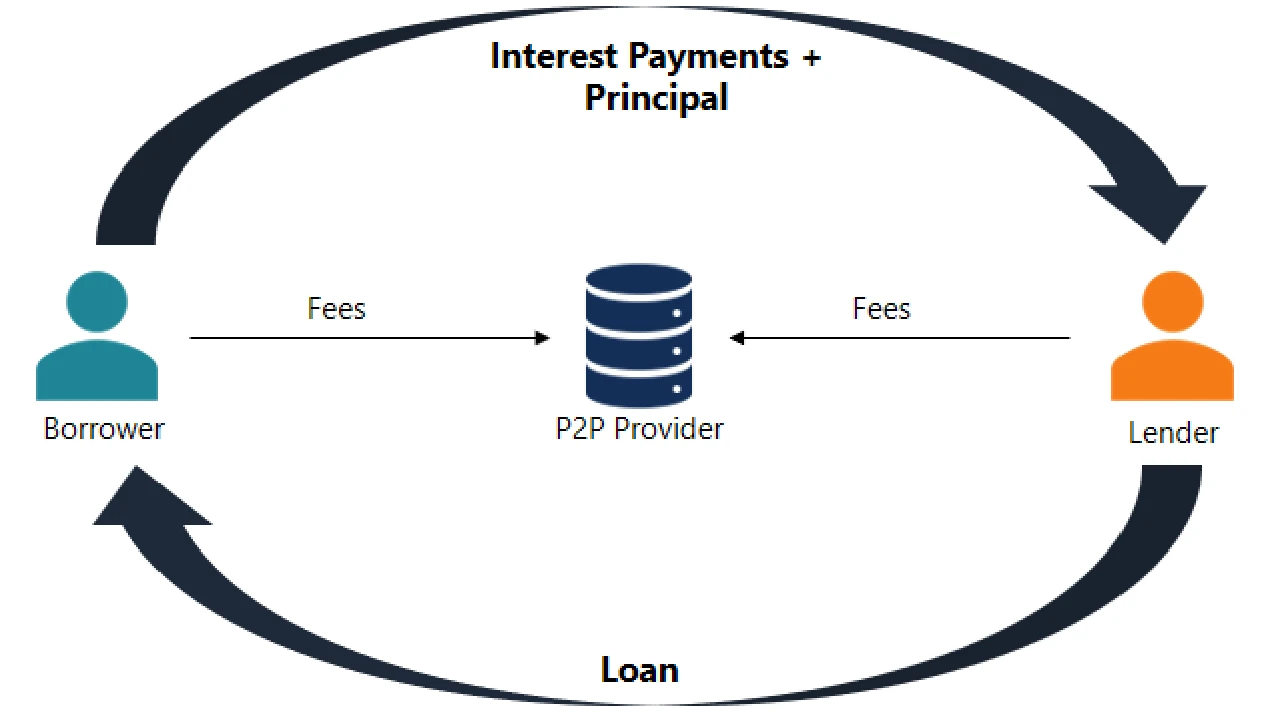

At its core, P2P lending is pretty simple. Instead of going to a bank for a loan, you go to a P2P platform. This platform acts as a marketplace, connecting individual borrowers with individual investors. Borrowers apply for loans, and investors browse through these loan listings, choosing which ones they want to fund. The platform handles all the nitty-gritty stuff like credit checks, loan servicing, and payment collection. It's a win-win: borrowers often get lower interest rates than traditional banks offer, and investors can earn higher returns than they would from a savings account or even some traditional investments. It's all about cutting out the middleman and passing those savings (or earnings) directly to you.

How Peer-to-Peer Lending Works for Borrowers and Investors

Let's break down the process for both sides of the coin.

For Borrowers Getting a P2P Loan

If you're looking for a loan, here's how it typically goes down:

- Application: You'll start by filling out an online application on a P2P lending platform. This will include personal information, financial details, and the reason for your loan.

- Credit Check: The platform will run a credit check to assess your creditworthiness. This helps them assign you a risk grade, which in turn determines your interest rate.

- Listing: If approved, your loan request will be listed on the platform's marketplace for investors to see. This listing will include your loan amount, interest rate, and a brief description (often anonymized).

- Funding: Investors will then review your listing and decide whether to fund all or part of your loan. Many loans are funded by multiple investors, each contributing a small amount.

- Disbursement: Once fully funded, the funds are disbursed to your bank account, usually within a few business days.

- Repayment: You'll make regular monthly payments to the platform, which then distributes the principal and interest to the investors.

Common uses for P2P loans include debt consolidation, home improvements, medical expenses, and even starting a small business. The beauty is the flexibility and often more favorable terms.

For Investors Earning Returns with P2P

If you're an investor, here's your journey:

- Account Setup: You'll open an investment account with a P2P platform and deposit funds.

- Browse Listings: You can then browse through thousands of loan listings, filtering by credit grade, loan purpose, interest rate, and term.

- Invest: You choose which loans to invest in. Most platforms allow you to invest as little as $25 per loan, which is fantastic for diversification.

- Receive Payments: As borrowers make their monthly payments, you'll receive your share of the principal and interest directly into your account.

- Reinvest or Withdraw: You can then choose to reinvest these funds into new loans or withdraw them.

The key for investors is diversification. By spreading your investment across many different loans, you minimize the risk of any single borrower defaulting.

Top Peer-to-Peer Lending Platforms A Comparative Look

Alright, let's talk about some of the big players in the P2P space. Each platform has its own quirks, so it's worth checking them out to see which one fits your needs best.

LendingClub A Pioneer in P2P

LendingClub is one of the oldest and largest P2P lending platforms in the US. They've facilitated billions in loans and are a go-to for many. They primarily focus on personal loans, often used for debt consolidation or large purchases.

- For Borrowers: You can apply for loans from $1,000 to $40,000 with fixed interest rates and terms of 3 or 5 years. Your rate depends on your credit score and financial history. They charge an origination fee, which is deducted from your loan proceeds.

- For Investors: You can invest in fractional loans, starting from $25 per note. LendingClub offers a wide range of loan grades, from A (lowest risk, lower return) to G (highest risk, higher potential return). They have an auto-invest feature that helps you diversify.

- Pros: Long track record, large volume of loans, good for diversification, user-friendly interface.

- Cons: Origination fees for borrowers, some investors report lower returns in recent years compared to earlier days, secondary market for notes can be illiquid.

- Typical Use Case: Debt consolidation for borrowers, diversified passive income for investors.

- Pricing (Example): For borrowers, rates can range from around 7% to 35% APR depending on creditworthiness. Origination fees typically range from 2% to 6%. For investors, historical returns have averaged around 4-7% after fees and defaults.

Prosper Another Established Player

Prosper is another veteran in the P2P lending scene, similar to LendingClub in many ways but with its own distinct features. They also focus on personal loans.

- For Borrowers: Loans range from $2,000 to $50,000 with terms of 3 or 5 years. Like LendingClub, your interest rate is determined by your credit profile. They also charge an origination fee.

- For Investors: You can invest in notes starting at $25. Prosper uses its own proprietary Prosper Rating (AA to HR) to assess borrower risk. They also offer an auto-invest tool.

- Pros: Established platform, good for diversification, clear risk ratings, strong community features.

- Cons: Origination fees for borrowers, similar to LendingClub, some investors might find returns have plateaued.

- Typical Use Case: Home improvement loans for borrowers, building a diversified portfolio for investors.

- Pricing (Example): Borrower rates typically range from 6.95% to 35.99% APR. Origination fees are between 2.4% and 5%. Investor returns have historically been in the 5-8% range.

Upstart AI-Powered Lending

Upstart takes a different approach by using artificial intelligence and machine learning to assess creditworthiness. They look beyond just your credit score, considering factors like education, job history, and even your field of study. This can be a game-changer for those with limited credit history but strong earning potential.

- For Borrowers: Loans from $1,000 to $50,000 with 3 or 5-year terms. Because of their AI model, they might offer better rates to individuals who are overlooked by traditional credit scoring models.

- For Investors: Upstart offers institutional investment opportunities, but also allows individual investors through their platform. Their AI-driven approach aims to identify lower-risk borrowers that traditional models might miss, potentially leading to higher risk-adjusted returns.

- Pros: Innovative AI-driven credit assessment, potentially better rates for 'thin file' borrowers, strong growth.

- Cons: Newer model, so less historical data than LendingClub/Prosper, origination fees apply.

- Typical Use Case: Recent graduates or those with limited credit history seeking personal loans, investors looking for a tech-forward approach to lending.

- Pricing (Example): Borrower APRs can range from 6.5% to 35.99%. Origination fees are 0% to 8%. Investor returns are often competitive, aiming for higher yields by identifying unique credit profiles.

Funding Circle Business P2P Lending

While the previous platforms focus on personal loans, Funding Circle is specifically for small business loans. This is a huge market, and P2P offers a great alternative to traditional bank loans for businesses.

- For Borrowers (Businesses): Small businesses can apply for loans from $25,000 to $500,000. They look at business financials, credit history, and time in business.

- For Investors: You can invest in business loans, which often come with higher interest rates than personal loans due to the perceived higher risk. This platform is more geared towards sophisticated or institutional investors, though individuals can participate.

- Pros: Specializes in business loans, potentially higher returns for investors, faster approval than traditional banks for businesses.

- Cons: Higher risk for investors due to business lending, minimum investment amounts can be higher for individuals.

- Typical Use Case: Small businesses needing capital for expansion or operations, investors seeking higher yields from business lending.

- Pricing (Example): Borrower rates vary widely based on business risk, typically from 5% to 25% APR. Origination fees apply. Investor returns can be higher than personal loans, but so is the risk of default.

Benefits of Peer-to-Peer Lending Why It's Gaining Popularity

So, why are so many people flocking to P2P? Let's break down the advantages.

For Borrowers Access and Affordability

P2P lending offers several compelling benefits for those seeking funds:

- Lower Interest Rates: Often, P2P platforms can offer lower interest rates than traditional banks, especially for those with good credit, because they have lower overheads.

- Faster Approval and Funding: The online application process is typically streamlined, leading to quicker approval times and faster disbursement of funds.

- More Flexible Criteria: Some platforms, like Upstart, use alternative data points, making loans accessible to a wider range of borrowers, including those with limited credit history.

- Fixed Payments: Most P2P loans come with fixed interest rates and terms, making budgeting predictable and straightforward.

- No Collateral Required: The vast majority of P2P personal loans are unsecured, meaning you don't need to put up assets as collateral.

For Investors Higher Returns and Diversification

For investors, P2P lending presents an attractive alternative to traditional investments:

- Potentially Higher Returns: P2P investments often offer higher interest rates than savings accounts, CDs, or even some bonds, providing a better return on your capital.

- Diversification: By investing small amounts across many different loans, you can significantly diversify your portfolio, reducing the impact of any single default.

- Passive Income: Once you've invested, the income stream is largely passive, with monthly payments flowing into your account.

- Low Barrier to Entry: With minimum investments as low as $25 per note, P2P lending is accessible to almost anyone, regardless of their investment capital.

- Transparency: Platforms provide detailed information about each loan, allowing investors to make informed decisions.

Risks and Considerations What to Watch Out For

It's not all sunshine and rainbows, though. Like any financial endeavor, P2P lending comes with its own set of risks. It's crucial to understand these before diving in.

For Borrowers Understanding the Terms

While P2P loans can be great, be aware of:

- Origination Fees: Most platforms charge an upfront origination fee, which is deducted from your loan amount. Make sure you factor this into your total cost.

- Interest Rates: While often lower than traditional banks, if your credit score isn't stellar, your P2P interest rate could still be high. Always compare.

- Impact on Credit Score: Applying for a loan will result in a hard inquiry on your credit report, which can temporarily ding your score. Missing payments will also negatively impact your credit.

For Investors The Default Risk

This is the big one for investors:

- Default Risk: Borrowers can default on their loans, meaning you might not get your invested capital back. This is the primary risk for P2P investors.

- Platform Risk: While rare, there's a risk that the P2P platform itself could go out of business. Most platforms have contingency plans, but it's a consideration.

- Liquidity: P2P investments are generally not as liquid as stocks or bonds. While some platforms have secondary markets for notes, you might not always be able to sell your notes quickly or at face value.

- Economic Downturns: In an economic recession, default rates tend to rise, which can significantly impact investor returns.

- Not FDIC Insured: Unlike bank deposits, P2P investments are not insured by the FDIC. Your capital is at risk.

To mitigate default risk, diversification is your best friend. Invest small amounts across hundreds, or even thousands, of different loans. This way, if a few borrowers default, it won't wipe out your entire portfolio.

Tips for Success Maximizing Your P2P Experience

Whether you're borrowing or investing, a few smart moves can make a big difference.

For Borrowers Smart Loan Strategies

- Improve Your Credit Score: Before applying, work on boosting your credit score. A higher score means a lower interest rate.

- Compare Offers: Don't just go with the first offer. Apply to a few different platforms to compare rates and fees.

- Understand the Terms: Read the fine print! Know your interest rate, fees, and repayment schedule.

- Borrow Only What You Need: Don't be tempted to borrow more than you actually require.

- Automate Payments: Set up automatic payments to avoid missing due dates and incurring late fees.

For Investors Intelligent Investment Approaches

- Diversify, Diversify, Diversify: We can't stress this enough. Spread your money across as many different loans as possible.

- Start Small: Begin with a smaller amount to get a feel for the platform and the market before committing more capital.

- Understand Risk Grades: Familiarize yourself with the platform's risk grading system and align your investments with your risk tolerance. Higher risk often means higher potential return, but also higher potential for default.

- Use Auto-Invest Tools: Many platforms offer auto-invest features that can automatically invest your funds based on your criteria, making diversification easier.

- Reinvest Returns: Compounding is powerful. Reinvesting your principal and interest payments can significantly boost your long-term returns.

- Monitor Your Portfolio: Regularly check your investments for any defaults or late payments.

- Consider Tax Implications: Interest earned from P2P lending is taxable income. Consult with a tax professional.

The Future of Peer-to-Peer Lending Innovation and Growth

P2P lending isn't standing still. It's constantly evolving, with new platforms emerging and existing ones refining their models. We're seeing more specialized platforms, like those focusing on real estate P2P lending or even invoice financing. The integration of AI and blockchain technology is also set to further enhance efficiency, security, and potentially lower costs. As traditional banking continues to evolve, P2P lending is likely to play an even larger role in the financial landscape, offering accessible and often more rewarding options for both borrowers and investors worldwide. It's an exciting space to be in, and with the right knowledge, you can definitely make it work for you.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)