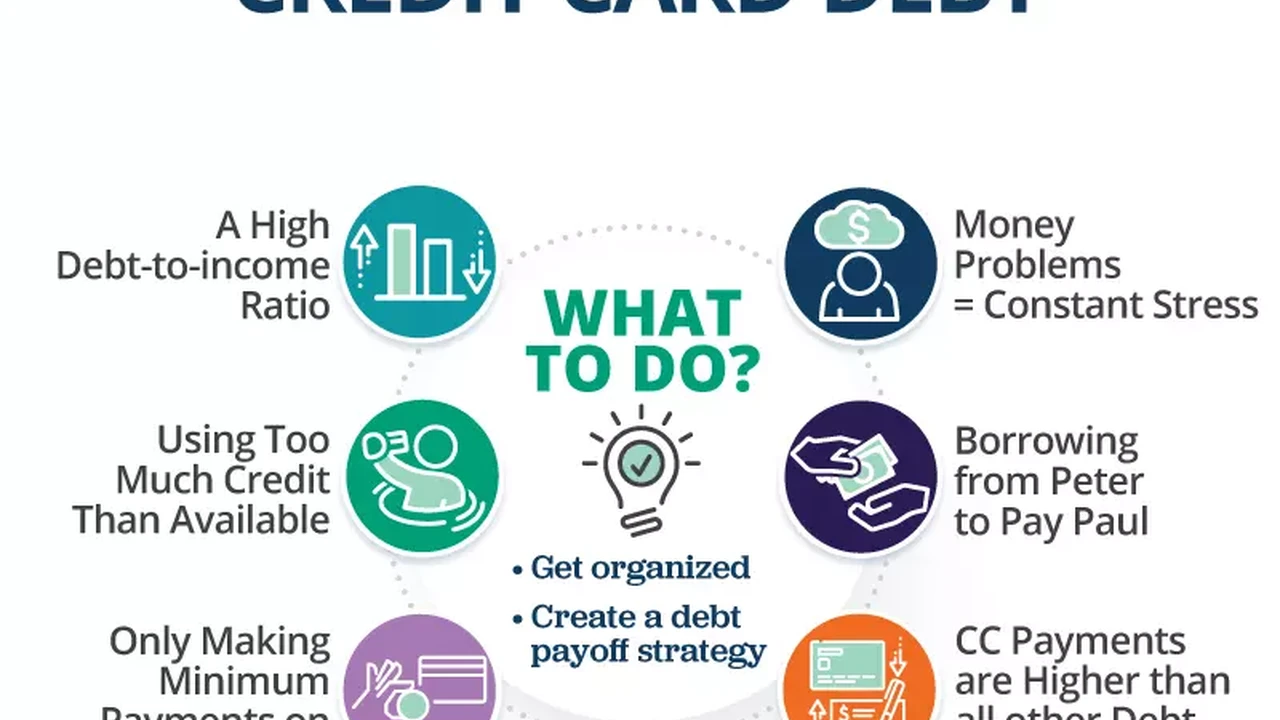

Top 4 Signs of Credit Card Debt Trouble

Identify the top 4 warning signs that indicate you might be facing credit card debt issues and need intervention.

Top 4 Signs of Credit Card Debt Trouble

Identify the top 4 warning signs that indicate you might be facing credit card debt issues and need intervention. It's easy to fall into the trap of credit card debt. Those plastic rectangles offer so much convenience and, let's be honest, a little thrill when you swipe them. But that convenience can quickly turn into a financial nightmare if you're not careful. Recognizing the early warning signs is crucial to getting back on track before things spiral out of control. Let's dive into the top four indicators that you might be heading for, or already in, credit card debt trouble.

Minimum Payments Are Your Only Option

One of the most glaring red flags that you're in credit card debt trouble is when paying only the minimum amount due becomes your standard practice. Credit card companies love minimum payments because they keep you in debt longer, meaning more interest for them. When you consistently pay just the minimum, a significant portion of that payment goes straight to interest, with very little chipping away at your principal balance. This means your debt barely shrinks, and it can feel like you're on a treadmill, running hard but getting nowhere.

Think about it: if your minimum payment is, say, 2% of your balance, and your interest rate is 20%, you're barely covering the interest, let alone making a dent in the actual money you owe. This cycle can lead to years, even decades, of debt. If you find yourself regularly choosing the minimum payment because you can't afford more, it's a strong signal that your spending is outstripping your income, and your credit card debt is becoming unmanageable.

Relying on Credit Cards for Essentials

Another major warning sign is when you start using your credit cards to pay for everyday necessities like groceries, utilities, or even rent. Credit cards are designed for convenience and, ideally, for purchases you can pay off in full each month. They are not meant to be an extension of your income or a substitute for an emergency fund. If you're swiping your card for basic living expenses because your checking account is running low before your next paycheck, you're in a precarious financial position.

This often indicates a cash flow problem. You're living paycheck to paycheck, or worse, spending more than you earn. Using credit for essentials means you're essentially borrowing money at a high interest rate for things you need to survive. This quickly compounds your debt, making it even harder to break free. It's a slippery slope where you're constantly playing catch-up, and the debt just keeps growing.

Maxing Out Your Credit Limits

When you consistently hit or come very close to hitting the credit limit on one or more of your credit cards, that's a huge flashing light indicating debt trouble. This isn't just about having a high balance; it's also about your credit utilization ratio, which is a key factor in your credit score. Your credit utilization is the amount of credit you're using compared to your total available credit. A high utilization ratio (generally anything above 30%) can significantly hurt your credit score, making it harder to get loans or even rent an apartment in the future.

For example, if you have a credit card with a $5,000 limit and you consistently have a balance of $4,500 or more, your utilization is 90% or higher. This tells lenders you're a high-risk borrower. Beyond the credit score impact, maxing out cards means you have no financial buffer for emergencies. Any unexpected expense, like a car repair or medical bill, will force you to either go over your limit (incurring fees) or find other, potentially more expensive, ways to borrow money. It's a sign that you're living on the edge, with no room for error.

Receiving Calls from Collection Agencies

This is perhaps the most severe and undeniable sign that you are deep in credit card debt trouble. If you're getting calls, letters, or emails from collection agencies, it means you've missed multiple payments and your account has likely been charged off by the original creditor. At this point, your credit score has already taken a significant hit, and the debt is now in the hands of a third party whose primary goal is to get you to pay up, often aggressively.

Collection agencies can be relentless, and dealing with them can be incredibly stressful. This stage indicates that your debt has become severely delinquent, and it will have a long-lasting negative impact on your financial health. It's a clear signal that you need immediate intervention and a comprehensive plan to address your debt. Ignoring these calls will only make the situation worse, potentially leading to lawsuits or wage garnishment.

What to Do When You See These Signs

Recognizing these warning signs is the first step. The next is taking action. Here are some practical steps and resources to help you get back on track:

Create a Detailed Budget and Track Spending

You can't fix a problem if you don't understand its scope. Start by creating a realistic budget. List all your income and all your expenses. Be honest with yourself about where your money is going. There are many tools to help with this. For instance, You Need A Budget (YNAB) is a popular budgeting app (around $14.99/month or $99/year) that helps you give every dollar a job. It's great for those who need a structured approach to budgeting and want to see where their money is truly going. Another option is Mint (free), which links to your bank accounts and credit cards to automatically categorize transactions, giving you a clear overview of your spending habits. For a more manual, but equally effective, approach, a simple spreadsheet or even a notebook can work wonders. The key is consistency.

Prioritize Debt Repayment Strategies

Once you have a clear picture of your finances, you can choose a debt repayment strategy. Two popular methods are the debt snowball and debt avalanche.

Debt Snowball Method

This method, popularized by Dave Ramsey, focuses on psychological wins. You list your debts from smallest balance to largest, regardless of interest rate. You pay the minimum on all debts except the smallest, on which you throw every extra dollar you have. Once the smallest debt is paid off, you take the money you were paying on that debt and add it to the minimum payment of the next smallest debt. This creates a 'snowball' effect, building momentum as you pay off each debt. It's great for people who need motivation and quick wins to stay on track.

Debt Avalanche Method

This method is mathematically more efficient. You list your debts from highest interest rate to lowest. You pay the minimum on all debts except the one with the highest interest rate, on which you focus all your extra payments. Once that debt is paid off, you move to the next highest interest rate. This method saves you the most money on interest over time. It's ideal for those who are disciplined and want to minimize the total cost of their debt.

Consider Debt Consolidation Options

If you have multiple high-interest credit card debts, consolidating them into a single, lower-interest payment can be a smart move. This simplifies your payments and can save you a lot of money on interest.

Personal Loans

Many banks and online lenders offer personal loans for debt consolidation. These typically have fixed interest rates and repayment terms, making your monthly payments predictable. Lenders like LightStream (interest rates from around 6% to 20% APR, depending on creditworthiness) are known for competitive rates for borrowers with excellent credit. SoFi (rates from around 8% to 25% APR) is another popular choice, offering loans with no origination fees. The best personal loan for you will depend on your credit score and the interest rate you qualify for. Always compare offers from multiple lenders.

Balance Transfer Credit Cards

Some credit cards offer 0% APR on balance transfers for an introductory period, often 12 to 21 months. This can be a fantastic way to pay down debt without accruing interest. However, there's usually a balance transfer fee (typically 3-5% of the transferred amount). Cards like the Citi Simplicity Card (0% intro APR for 21 months on balance transfers, then variable APR) or the Wells Fargo Reflect Card (0% intro APR for 21 months on balance transfers, then variable APR) are good examples. The key here is to pay off the transferred balance entirely before the introductory period ends, or you'll be hit with high interest rates. This option is best for those who are confident they can pay off the debt within the promotional period.

Seek Professional Help

If you feel overwhelmed or unsure how to proceed, don't hesitate to seek professional help. A non-profit credit counseling agency can provide invaluable guidance.

Credit Counseling Agencies

Organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) can connect you with certified credit counselors. These counselors can help you create a budget, explore debt management plans (DMPs), and negotiate with creditors on your behalf. A DMP involves making one monthly payment to the agency, which then distributes the funds to your creditors. This often results in lower interest rates and waived fees. While there might be a small monthly fee for a DMP (e.g., $25-$50), the savings on interest can be substantial. They can also help you understand your options, including bankruptcy, if necessary. Their services are often free for initial consultations.

Financial Advisors

While credit counselors focus specifically on debt, a financial advisor can provide a broader perspective on your overall financial health, including investments, retirement planning, and long-term wealth building. If your debt is part of a larger financial picture you want to optimize, a fee-only financial advisor might be a good fit. Services can range from hourly rates ($150-$300/hour) to a percentage of assets under management (0.5% - 1.5% annually). Firms like Vanguard Personal Advisor Services offer lower-cost advisory services (around 0.30% of assets annually) for those with investment portfolios.

Preventing Future Debt Trouble

Once you're on the path to recovery, it's essential to put measures in place to prevent falling back into debt. Build an emergency fund, even if it's just a small amount to start. This acts as a buffer for unexpected expenses, so you don't have to rely on credit cards. Live below your means, meaning spend less than you earn. Review your budget regularly and adjust as needed. Be mindful of your spending habits and avoid impulse purchases. And finally, educate yourself continuously about personal finance. The more you know, the better equipped you'll be to make smart financial decisions and maintain your financial health.

Recognizing the signs of credit card debt trouble is the first, crucial step towards financial recovery. By taking proactive measures, utilizing available resources, and committing to responsible financial habits, you can overcome debt and build a more secure financial future. Don't let the plastic control your life; take charge and master your money.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)